18-Aug-2025

Believe it or not, stepping into homeownership isn’t just a mere milestone – it’s a remarkably wise financial decision. Needless to say, aside from growing your equity and having a place that truly feels like yours, the first-time homebuyers gain access to valuable tax advantages.

The tax system of the United States includes credits and write-offs, which might result in significant savings. Yet, many ignore them simply because they are uncertain about what benefits apply.

Yet, many overlook them simply because they’re unsure what benefits apply. Notably, more than 37 million Americans have benefited from interest-related deductions on their home financing over the recent years.

So, how much can you save? You can read our blog “How Much Tax Benefit For Home Loan in the USA” for more genuine and accurate insights.

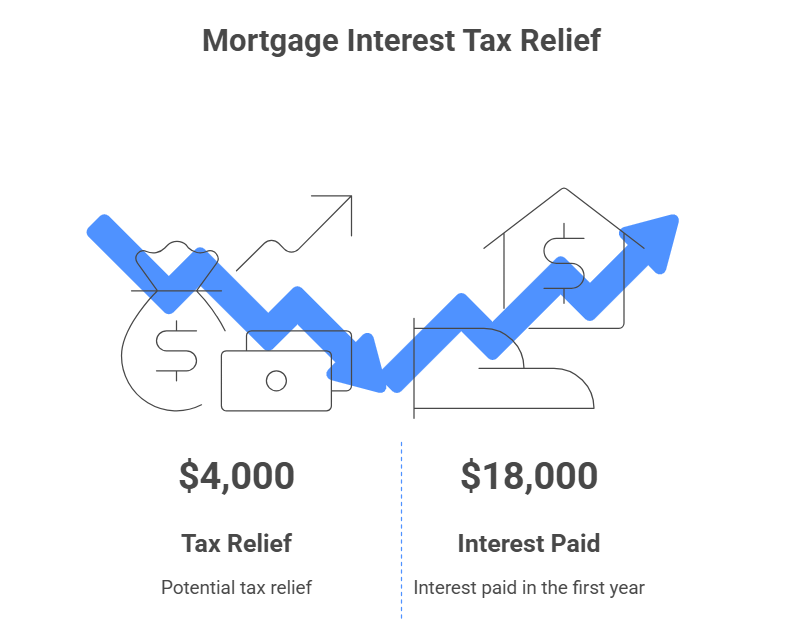

One of the most remarkable tax benefits available to property owners is the Mortgage Interest Deduction. It enables you to subtract the interest incurred on your home financing from your reportable income – greatly reducing your tax liability.

Starting in 2025, you can deduct charges on home loans up to $750,000 (or approximately $375,000 if filing separately as a married individual).

For instance, on a $300,000 mortgage with up to a 6% interest rate, you might incur approximately $18,000 in interest during the first year. If you fall under the 22% tax bracket, this might translate into around $4,000 in potential tax relief.

Under the State and Local Tax (SALT) deduction, you can easily write off up to $10,000 of the overall state and local income, sales, and real estate taxes.

If you have been paying PMI, aka private mortgage insurance – often essential especially when your initial deposit is below 20% – you may qualify to claim those costs on your tax return.

At present, this deduction is subject to annual renewal by Congress. Confirm whether it remains in effect for 2025.

The benefit gradually minimizes for adjusted gross incomes going beyond $100,000 (or approximately $50,000 for those filing separately as married individuals).

Make sure that you refer to the figure listed on Form 1098, supplied by your mortgage provider.

Even though the nationwide first-time buyer tax benefit was discontinued after 2010, many local and state programs continue to bring meaningful advantages to the fore.

For instance –

Features an MCC (Mortgage Credit Certificate) initiative.

CalHFA delivers tax relief options as well as support with initial payments.

TDHCA extends MCCs along with additional grants for those buying a home for the first time.

Pro Tip: It’s advisable that you connect and consult the housing authority of your state to explore different programs you might be eligible for.

Due to the IRA (Inflation Reduction Act), new homeowners can easily apply for federal tax credits while adding energy-smart systems to their properties.

Eligible upgrades cover the following –

However, credits could differ by 30% of the total expenses for approved enhancements – potentially slashing thousands from your expenses.

Looking to run your own business from your home? If a dedicated chunk of your living space is used particularly and consistently for work, you may gain the eligibility for a home office tax break.

This benefit doesn’t apply to salaried (W-2) employees. It’s actually designed for independent professionals, entrepreneurs, and gig workers.

You may be able to claim part of your housing expenses including internet, repairs, electricity, rent or mortgage, etc., depending on how much of your house is allocated for business goals.

A quick example – If your workspace occupies up to 10% of your home’s overall area, you may write off 10% of eligible home-related expenses.

The importance of picking the right deduction strategy is paramount to maximizing your savings –

| Deduction Type | Single Filer (2025) | Married Filing Jointly (2025) |

| Standard | $14,600 | $29,200 |

| Itemized | Differs – includes SALT, mortgage interest, etc. | Fluctuates – higher potential savings |

If your claimable amounts such as property taxes, mortgage interest, PMI, etc. surpass the standard deduction, breaking down your deductions may result in a larger tax refund.

Expert Tip – Make sure that you rely on robust tax software or talk to a CPA to compare both options.

Are you planning to purchase a property with your partner or spouse? This is how you can reap the dividends of your tax perks –

Not married? No problem! Just maintain detailed records of individual financial contributions to prevent potential issues with the IRS.

Even with the best of intentions, many new homeowners might fall into preventable tax traps –

Consider keeping a record of every crucial form, communication, and document. Filing your taxes would be a lot easier – and potentially far more beneficial.

No doubt, owning a home is a lot more than just having a roof over your head! It’s rather a very powerful tax-saving tool. By leveraging property tax, state-level credits, and mortgage interest, you can save a significant amount in your very first year.

Filing with a knowledgeable and reliable tax expert can actually help you unlock hidden opportunities and keep costly mistakes at bay.