20-Aug-2025

Are you thinking about claiming your mortgage interest sometime in 2025? The rules and regulations have changed in leaps and bounds – again! What was once a generous tax break for millions of business owners in the U.S., has started witnessing some serious reforms.

In case you are still counting on the pre-2018 limits, it’s high time that you run a reality check! The federal TCJA (Tax Cuts and Jobs Act) of 2017 shook things up, and for the year 2025, you are required to know specifically what applies. Are you looking to buy a home? Maybe planning for refinancing? Or, just doing your taxes?

Here’s what has changed – and how you can plan more wisely and smartly –

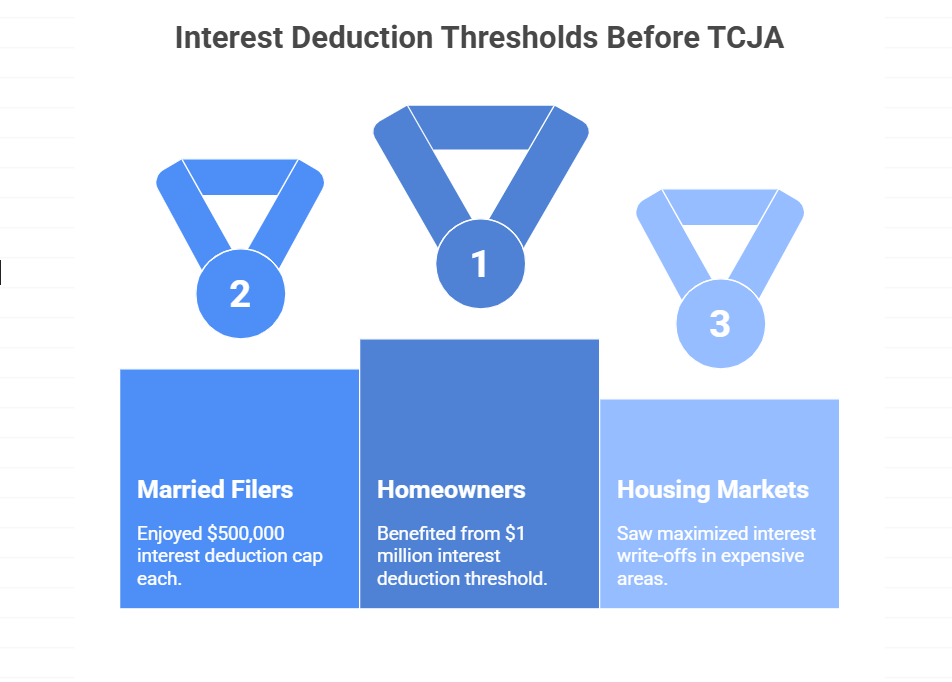

Before the TCJA took effect, American houseowners largely benefited from higher interest deduction thresholds. Specifically, you could deduct the interest on around $1 million in home loan debt used to construct, purchase, or significantly upgrade your primary or secondary residence. If you were married and filed separately, the cap was set at around $500,000 for each filer.

Key takeaway – The $1 million limit served as a valuable advantage, especially in expensive housing markets, allowing many buyers to maximize their interest write-offs and reduce yearly tax burdens.

Beginning with the 2018 tax year and continuing through 2025, the TCJA reduced the maximum deductible amount to $750,000 for newly issued mortgages. For individuals who are married and filing separately, the threshold drops up to $375,000.

This adjustment only affects loans issued after December 15, 2017. Mortgages secured before that particular date are usually grandfathered under the previous $1 million limit.

To gain eligibility for the mortgage interest deduction, the loan should be used specifically to purchase, construct, or boost a primary or secondary residence. Cash-out refinances, HELOCs, and home equity loans are only deductible when the funds are applied toward home improvement projects – not for any personal expenses.

When lawmakers enacted the TCJA, the revised mortgage interest limit was initially set to lapse after 2025, along with several other individual tax breaks. At the time, homeowners, property industry stakeholders, and tax advisors were expecting a potential reinstatement of the $1 million threshold – or the introduction of even more sweeping reforms if Congress remained inactive.

In 2024, Congress approved a comprehensive tax overhaul (informally called the One Big Beautiful Bill Act) that reaffirmed and permanently established the $750,000 cap for mortgage interest deductions. This policy move was aimed at providing clarity for homeowners and avoiding abrupt tax changes that might impact the housing sector.

There is no longer an expiration date. The $750,000 threshold (or $375,000 for separate filers) is now a fixed rule for all newly issued mortgages – until or unless future congressional action modifies it.

If you’re looking to purchase property or refinance your mortgage in 2025 or beyond, the $750,000 interest deduction ceiling is your new benchmark. The legislation is firm and consistent – there’s no chance of the previous $1 million limit returning post-2025.

If your home loan was finalized before December 16, 2017, you can still claim interest deductions on up to $1 million in qualifying mortgage debt ($500,000 for separate filers), as long as the original loan remains active.

This grandfather clause remains valid, but it’s strictly limited to those earlier loans – it doesn’t apply to refinanced or newly issued mortgages after that cutoff.

With the $750,000 threshold now firmly established, homeowners, buyers, and property industry experts should incorporate this ceiling into all upcoming financial and tax strategies. Key areas of impact include:

Gone are the days of uncertainty over whether the TCJA provisions would expire. At present, with permanence, both financial advisors as well as individual taxpayers can plan with confidence for the long term – reducing the risks of shocks or unexpected surprises in upcoming tax years.

| Period / Loan Date | Mortgage Cap | Filing Status |

| Pre-Dec 16, 2017 mortgages | $1,000,000 ($500,000 MFS) | Married Filing Separately (MFS) |

| Post-Dec 15, 2017 mortgages (and beyond) | $750,000 ($375,000 MFS) | New permanent legislation |

Factor the $750,000 cap into your budget – particularly in high-cost regions. Understand how much interest you can write off and what expenses you’ll need to pay out of pocket.

Make sure that you weigh all the perks of a new loan against the risk of losing “grandfathered” status.

Do you already have a grandfathered mortgage? If yes, then ask yourself – will modifying or updating your loan push you into the revised, lower threshold?

With the limits firmly in place, smart tax strategy is more important than ever. Reach out to a professional and reliable tax advisor to reap the dividends of your eligible write-offs and prepare for what’s next.

In essence: The federal cap on mortgage interest deductions is fixed at around $750,000 for new loans, with no intention or exact end date to respond to the previous $1 million threshold.

Loans originated prior to December 16, 2017, continue to qualify for the higher limit –but for every other borrower, the revised rule is the latest standard!