26-Oct-2025

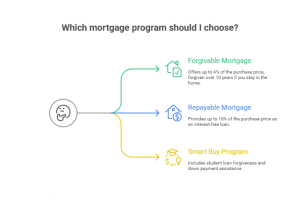

Access Forgivable Mortgage

Provides up to 4% of the purchase price, up to $6,000. The loan is forgiven monthly over 10 years if you stay in the home. Available statewide for first-time and repeat buyers. Requires a minimum credit score of 640, completion of homeownership counseling, and a personal contribution of at least $1,000 or 1% of the purchase price.

Access Repayable Mortgage

Provides up to 10% of the purchase price, up to $10,000. This is an interest-free loan repaid over 10 years. Available statewide for first-time and repeat buyers. Requires a minimum credit score of 640, homeownership counseling, and a personal contribution of at least $1,000 or 1% of the purchase price.

Smart Buy Program

Provides up to $40,000 in student loan forgiveness and $5,000 for down payment and closing costs. Must have at least $1,000 in student loan debt. Requires a minimum credit score of 640, homeownership counseling, and a personal contribution of at least $1,000 or 1% of the purchase price.

Alton

Offers down payment and closing cost assistance for income-eligible homebuyers. First-time buyers are preferred.

Decatur

Provides up to $14,999 for down payment and closing costs. First-time buyers preferred.

Peoria

Provides up to $5,000 for down payment and closing costs. First-time buyers preferred.

Rockford

Provides up to $14,999 for down payment and closing costs. First-time buyers preferred.

Springfield

Offers down payment and closing cost assistance for low-income first-time buyers.

Cook County

As of June 2025, the program has no funds and is not accepting new applications.

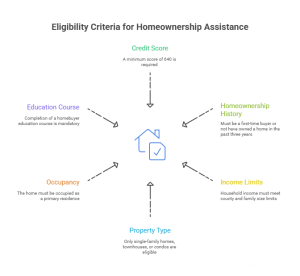

Minimum credit score of 640

Must be a first-time buyer or not have owned a home in the past three years

Must meet household income limits based on county and family size

Property must be a single-family home, townhouse, or condo

Must occupy the home as a primary residence

Must complete a homebuyer education course

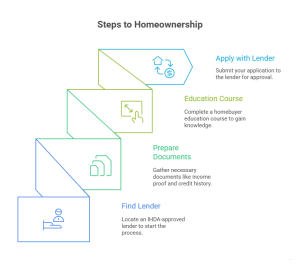

Find an IHDA-approved lender at IHDA Mortgage

Prepare proof of income, credit history, and other documents

Complete a homebuyer education course

Apply with your lender