26-Oct-2025

What these programs do ?

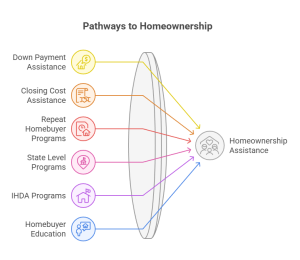

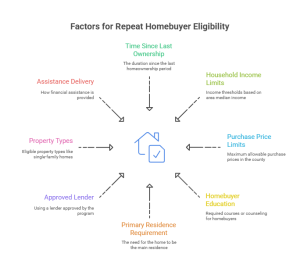

They help with down payment and sometimes closing costs. Repeat homebuyers are people who owned a home before. Some programs treat them like first time buyers if enough time has passed since prior ownership.

State level programs to check

Illinois Housing Development Authority IHDA runs the main programs. Most IHDA help targets first time buyers or people who have not owned a home for a set number of years. IHDA offers down payment assistance that can be a forgivable loan if you live in the home for the required time. Amounts, income limits, and purchase price caps vary. You must use an IHDA approved lender and complete a homebuyer education course.

What to check for as a repeat buyer ?

How to apply ?

Practical tips for 2025

Check IHDA and local municipal programs for updates. Local cities or counties sometimes offer help that state programs do not. Keep proof of prior ownership and income ready. Budget for closing costs and repairs because DPA may not cover everything. Ask the lender how the assistance affects your mortgage and what would trigger recapture.

Extra note

There are legislative proposals that could change options for people who have not owned in a long time. Policies can change during the year. Verify the current rules before you apply.