26-Oct-2025

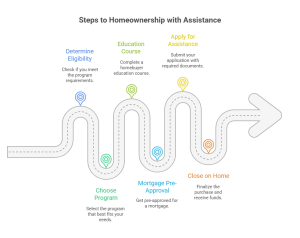

Eligibility depends on the program. Common requirements include:

First-Time Homebuyer: Usually you must not have owned a home in the last three years.

Income Limits: Household income must be below a set percentage of the area median income.

Credit Score: Most programs require a minimum score around 620–660.

Property Location: The home must be in Illinois and meet program rules.

Occupancy: The home must be your primary residence.

Example: Cook County Homeowner Relief Fund applicants must have income at or below 100% of the area median income and show a property tax increase of 50% or more since 2021.

Some key programs are:

IHDA Access Forgivable: 5-year forgivable loan for down payment and closing costs.

IHDA Access Deferred: 10-year deferred loan repaid when the home is sold or refinanced.

IHDA 1stHomeIllinois: Helps first-time buyers with lower mortgage insurance costs.

Cook County Homebuyer Assistance Program: Offers up to $10,000 for eligible buyers.

Most programs require a HUD-approved course. These teach budgeting, mortgages, and home maintenance. Courses can be online or in person.

Get pre-approved from a participating lender before applying for DPA. This shows you can repay the loan and is often required for the application.

Submit your application through the program portal or lender. Include all required documents to avoid delays.

Once approved, the funds go toward your down payment or closing costs. Follow your lender’s closing process.

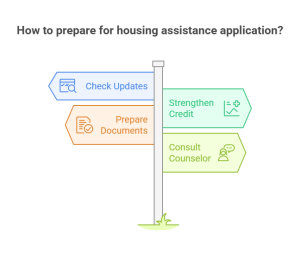

Check Updates: Look at the Illinois Housing Development Authority (IHDA) website or local housing authority for program news.

Keep Your Credit Strong: A better score can improve your chances and loan terms.

Prepare Documents: Have tax returns, pay stubs, and bank statements ready.

Ask a Housing Counselor: A HUD-approved counselor can guide you through the process.