04-Jun-2025

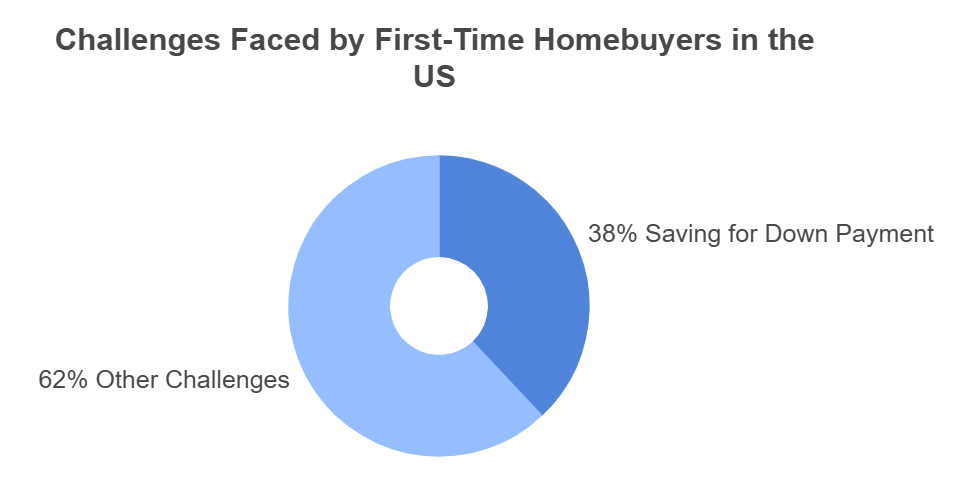

Buying a house is a dream for many, but let’s face the truth – coming up with a down payment can be a huge roadblock, particularly for first-time buyers. As per the NAR (National Association of Realtors), approximately 38% of first-time homebuyers in the United States claim that saving for a down payment is a challenge of the overall process.

And with house prices soaring, even just a modest 5% down payment can contribute to thousands of dollars. That’s why, it’s no surprise one of the most common queries people ask is – “Can I get a mortgage without any down payment?”

The answer is – yes, it’s possible!

However, there are certain things you must know prior to going down that way. In the following guide, we are breaking down the kinds of loans, which provide zero down payment, the advantages or disadvantages, who qualifies, and things to expect if you are considering this route.

So, what does “no down payment” actually mean? Let’s find out –

A zero down payment mortgage denotes you need not make an upfront payment toward the buying price of the house. Generally, lenders ask for around 3% to 20% of the home price as a down payment. However, certain government-backed as well as lender-specific programs provide alternatives, which eliminate this upfront cost – in case you qualify.

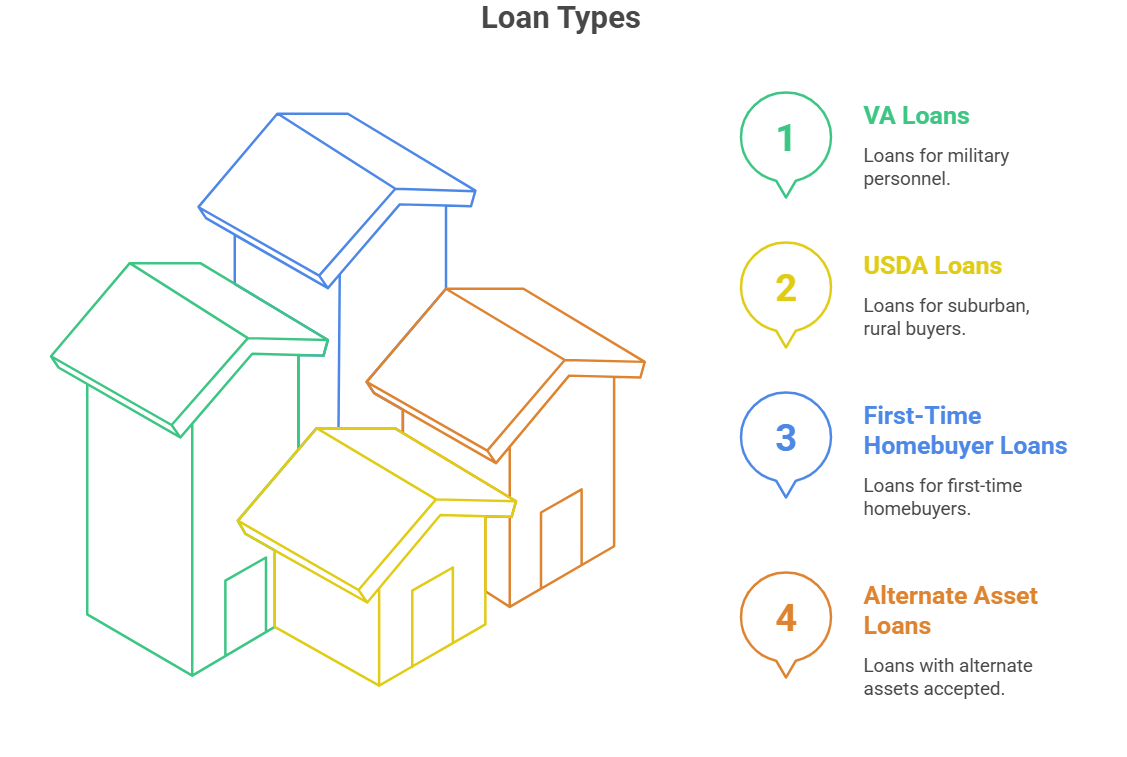

Yes, you can – in case you meet the criteria for certain loan programs tailored for zero-down borrowers. All these programs are primarily provided through government-backed loans, which aim to make homeownership a lot more accessible, particularly for first-time homebuyers, veterans, or those buying in rural areas.

While not everyone will certainly qualify, understanding every option available can help you in planning your next steps confidently. Below are mentioned some of the commonest zero-down mortgage programs and things you should learn about each one.

In case you’re a former or current member of the military, you might qualify for a VA loan. All these loans are backed by the U.S. Department of Veterans Affairs and need –

Tailored for rural as well as certain suburban areas, USDA loans also come up with the followings –

To qualify, your overall income should fall within a certain range, and the house should be in an eligible area. Check your eligibility.

Some private and local lenders provide a number of zero-down loan options for those, looking to buy their home for the first time. These often need –

This alternative phrasing of the question is frequently searched over the Internet, and it reflects the same concern. In case you are wondering, “Can I get a mortgage without a down payment?” the response still comes down to certain requirements or criteria for eligibility.

Feeling excited already? Hold on! You first need to understand what ‘zero down’ exactly refers to – as while the down payment may be waived, other upfront prices still apply. Have a look –

While there are some programs that don’t really require any down payment, you still must cover the followings –

So, while you are skipping the down payment part, you are not really escaping all upfront costs.

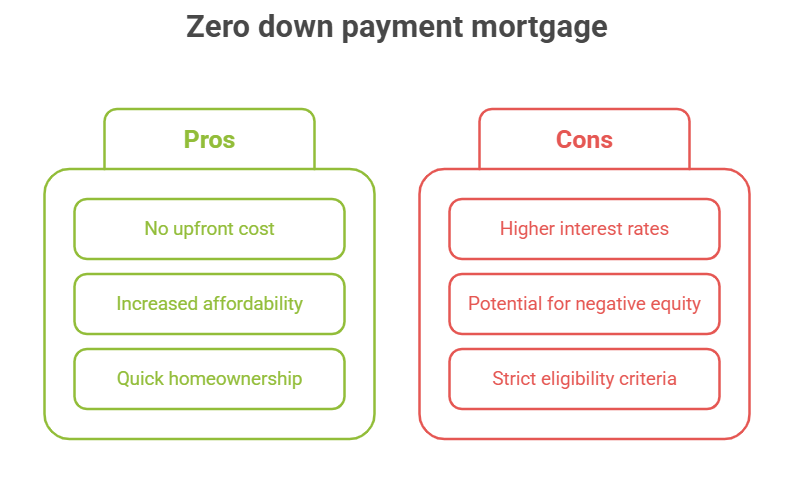

Below are mentioned some of the core advantages and disadvantages of down payment mortgages –

Zero-down-payment mortgages aren’t suitable for everyone. These loans are tailored for certain groups of borrowers who match certain criteria. Gaining an understanding of who qualifies can help you decide whether this option is realistically within reach.

If you fall into any of these abovementioned categories, you might gain eligibility for one of the programs discussed above.

It’s not at all challenging to increase your chances of approval. Just follow these below-mentioned tips, and you are good to seal the deal –

Getting a mortgage without any down payment could be an amazing opportunity – especially if you’re financially eligible and prepared. These loans reduce the barrier or challenges to homeownership, but they’re not devoid of risks or drawbacks.

So, make sure that you thoroughly weigh the advantages and disadvantages, conduct deep research, and consult a reliable mortgage advisor before taking the plunge.

Need professional assistance for getting started? Or, confused on who to consult for genuine help or unbiased advice? Let Club 720 be the saviour! As a leading non-profit fintech platform. Club 720 is aimed at making financial empowerment and homeownership accessible to everyone.

Through personalized support, strategic partnerships, and educational resources, Club 720 can simplify the overall journey to homeownership and mitigate the wealth gap in communities across the U.S. You can consult a certified and experienced mortgage expert of Club 720 to get the right guidance on zero a down payment mortgage.