25-Jun-2025

Buying a house is one of the most exciting yet highly nerve-wracking milestones in life. Whether you are buying your house for the first time or thinking about upgrading, chances are you have caught yourself asking, “How much is a down payment on a house?”

Great news – you are not alone! In fact, this is one of the most frequently asked questions people ask, especially when they begin to dream about homeownership. And while the response isn’t one-size-fits-all, this blog will take you through everything you must know – without any financial hassle or jargon.

Let’s break it down in simple terms –

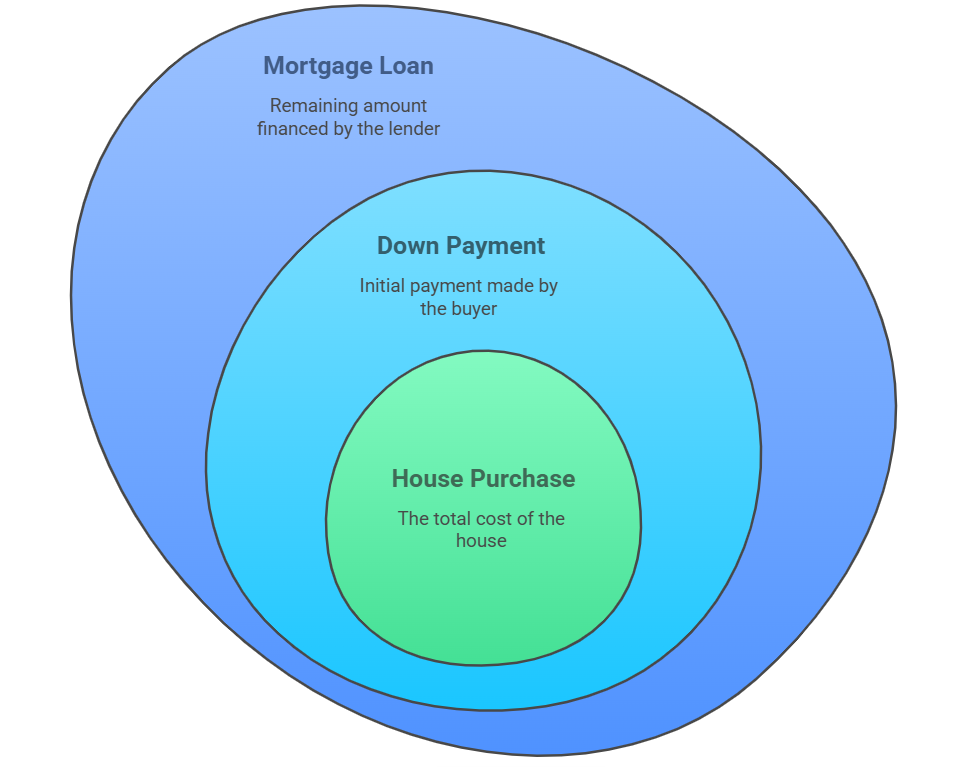

A down payment in a house refers to the chunk of money you pay upfront while buying a home. Think of it as your upfront investment in the property – the rest is usually financed through a mortgage.

Most lenders calculate your down payment as a percentage of the purchase price of the house. For example, if you’re purchasing a $300,000 house and you put down around 10%, that’s an approximately $30,000 down payment. The remaining $270,000 is covered by your mortgage loan.

But here’s the catch – you don’t always need to put down 20% in spite of what many people assume. In fact, the average down payment in the United States is closer to around 6% for first-time buyers, as per the National Association of Realtors.

It depends on a multitude of factors –

Different types of mortgages have different down payment requisites –

That’s right – there are multiple ways to get a mortgage without a down payment, but they are generally tied to certain eligibility criteria (more on that shortly!).

Higher credit scores as well as strong finances can often help you in qualifying for a lower down payment. However, if your credit is inconsistent, lenders may need you to put more money down to minimize their risk.

Naturally, the more expensive the house, the more you will need to put down – unless you’re making use of a percentage-based plan (like around 3% or 5%).

| Home Price | 3% Down | 10% Down | 20% Down |

| $250,000 | $7,500 | $25,000 | $50,000 |

| $350,000 | $10,500 | $35,000 | $70,000 |

| $500,000 | $15,000 | $50,000 | $100,000 |

As you can see, even a very small percentage could be a significant amount, particularly in high-cost markets.

Don’t panic or stress out – many buyers cannot! And that’s absolutely okay.

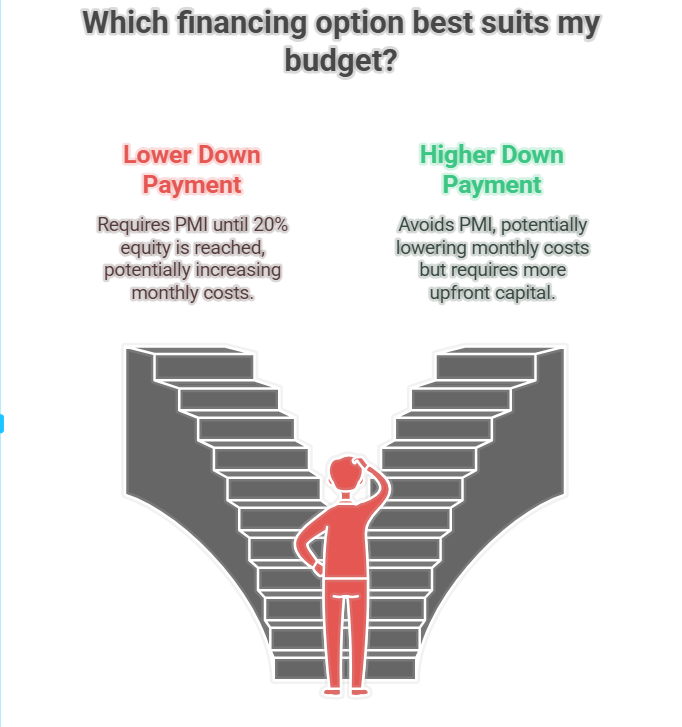

The crucial thing is finding the right financing option that perfectly suits your budget. For instance, in case you go with a lower down payment (say, around 3% to 5%), you may be required to pay PMI (private mortgage insurance) until you reach approximately 20% equity in your house.

PMI generally costs between 0.5% and 1% of the loan amount per year, but for a number of buyers, it’s a reasonable compromise to get into a home sooner.

Yes, absolutely! There are tons of DPAs (down payment assistance programs) available, particularly for first-time buyers. These can be offered as forgivable loans, grants, or deferred-payment loans.

There are some sources of down payment assistance, including the following –

Also, you can use gift funds from family that many lenders allow – provided that the money is documented properly.

Yes, but there’s a catch. You typically need to qualify for specific government-backed loans to buy a home with no down payment:

While not everyone qualifies, these are legit zero-down options for those who do.

There’s a reason the 20% figure is so widely popular – it helps you avoid PMI, decreases your monthly mortgage payment, and could provide you with better loan terms. However, don’t let it hold you back.

Here’s the deal: Taking years to accumulate 20% may cost you more in the increasing home prices and rent than only buying sooner with a lower PMI and down payment.

The most ideal approach? Consider running the numbers depending on your financial objectives, local market, and timeline.

Need any help in building that down payment fund? Try these –

So, how much is a down payment on a home? Truth be told, it depends on your financial picture, loan type, and the house you want. There are some buyers who get in with around 3% down; others opt for 20%, and just a lucky few qualify for zero-down mortgages. There’s no perfect amount – just the one that perfectly aligns with your requirements.

Before you embark on house-hunting, make sure that you check eligibility for various mortgage options as well as assistance programs. It can make a big difference in what you should save – and how fast you can move in.

Whether you are some weeks apart from purchasing or just starting your research –

Because your dream house? It’s closer than you imagine!