02-Jul-2025

Let’s face the truth – saving for a house down payment can feel next to impossible, especially if prices keep climbing. For many, it’s a serious dilemma between homeownership and renting! This dilemma is where the importance of no-money-down home buying options steps in. These programs enable qualified buyers to avoid the hefty upfront cost – without putting their aspiration on hold.

But who actually qualifies? And are they legit? In our blog, we will walk you through legitimate, practical ways to buy a home with zero down – and help you understand if you’re eligible.

Yes, it’s truly possible – but it’s not meant for everyone! “No money down” doesn’t always mean buying a home for free. You will still have to pay closing costs, and you should meet specific eligibility requirements. These programs are restricted to select groups such as rural homebuyers, veterans, or low-to-moderate-income families.

Bottom line – It’s doable in case you qualify – but do your homework prior to diving in. Don’t forget to check eligibility!

If you’re purchasing in a rural area, the USDA (U.S. Department of Agriculture) provides loans with 0% down payment – yes, seriously. All these loans are tailored to help low-to-moderate-income buyers in buying homes in qualifying areas.

The catch? Not all locations qualify, and your income should fall within a set range. You’ll still have to cover the closing costs, even though some sellers might agree to pay them.

Ideal for – First-time buyers in rural communities. Don’t forget to check eligibility!

If you’re an active-duty service member, a veteran, or an eligible spouse, the Department of VA (Veterans Affairs) provides one of the most effective home loan options available – with zero down payment, no private mortgage insurance (PMI), and competitive interest rates.

VA loans often come with more flexible credit requirements, making them perfect for those who served.

Perfect option for – Veterans and military families. Don’t forget to check eligibility!

Many cities and states provide DPAs (down payment assistance programs) for first-time buyers. You may receive low-interest loans, grants, or even conditional loans, which don’t need to be repaid if you meet specific requirements.

Eligibility sometimes depends on your location, profession, or income. While not always 100% zero-down, they can significantly minimize how much you pay upfront.

Ideal for – Buyers with local ties or moderate incomes. Don’t forget to check eligibility.

Seller financing refers to the seller acting as your lender, possibly bypassing traditional mortgage criteria. These options could be a bit riskier, so make sure that you consult a professional real estate attorney prior to signing anything. Don’t forget to check eligibility.

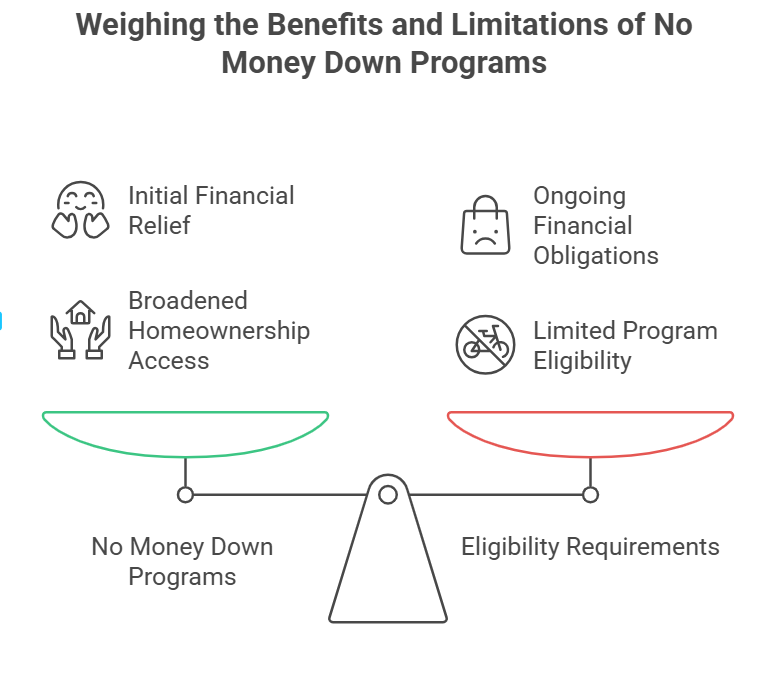

Buying a house with no money down could seem appealing, but it comes with certain risks. While you skip a large upfront payment, you may encounter higher monthly costs, very limited equity, and more stringent loan terms. If the overall value of your property falls, you might end up owing more than the house’s market value – making it more challenging to sell or refinance.

Competitive housing markets may give preference to buyers with larger down payments, which can ultimately weaken the appeal of your offer.

Yes, of course! While a down payment isn’t needed, you may still be liable for closing costs, until or unless they’re covered by a specific program or the seller.

Yes, especially for DPAs or USDA loans, but you should meet location, income, and sometimes profession-centric criteria.

Don’t forget to check eligibility requirements with your housing agency or lender to skip surprises later in the overall process.

Yes, you can buy a home with no money down – but these options aren’t suitable for everyone. Each comes with unique benefits, risks, and eligibility rules. Whether you’re a rural buyer, veteran, or someone looking for professional assistance, the key is exploring your options and preparing for the future.

Whenever in doubt, ensure that you talk to a reliable housing counselor or lender prior to making a move. Don’t forget to check eligibility!