21-Apr-2025

For a number of aspiring homeowners, saving up for a down payment is a serious obstacle on the path to making a purchase of a home. However, what if you could easily skip that step completely?

Looking for a home in Indiana? Here’s some good news—VA and USDA loans allow qualified buyers to make a purchase of a house with no down payment loan Indiana!

In Indiana, several types of loans and programs are available that provide no down payment options. Every program has its own eligibility needs, perks, and application processes. This comprehensive guide synthesizes information from different sources to offer a detailed overview of the options available to Indiana’s prospective homebuyers.

Let’s break down how these options for zero down payment work in Indiana – and, how you can reap their dividends –

According to research, the primary options for a no down payment loan in Indiana include USDA loans, VA loans, and the HomeStart program provided by First Option Mortgage. All these programs come with their own share of eligibility benefits and requirements. Don’t forget to check eligibility.

According to research, the major options for a no down payment loan Indiana include USDA loans, VA loans, and the HomeStart program provided by First Option Mortgage.

Each of these programs has its own share of perks and eligibility criteria. Hence, it’s important to check eligibility to decide which option is the perfect fit to fulfil your homebuying requirements.

In addition to this, for those who might not qualify for such specific loans, there are different forms of down payment assistance in Indiana, which can bring more accessibility to homeownership.

VA loans – backed by the U.S. Department of Veterans Affairs – are tailored for active-duty military personnel, eligible surviving spouses, and veterans. These loans offer around 100% financing, implying no down payment is needed, which is a remarkable advantage for eligible borrowers.

Reserved mainly for active-duty military, eligible surviving spouses, or veterans. Specific service needs should be met that can be verified through the VA.

The home should pass a VA appraisal, ensuring that it meets certain standards. Fixer-uppers are typically ineligible, as the property should be in a liveable state.

While there’s no down payment, borrowers are required to pay the closing costs that can often be negotiated with the seller. Also, there’s a nominal out-of-pocket requirement for a deposit, although this is generally basic and minimal.

Always keep in mind that VA Loans are particularly beneficial for veterans, providing them with a more seamless pathway to homeownership through a no down payment loan in Indiana. The only drawback is that this option is exclusively available to individuals with a military service background.

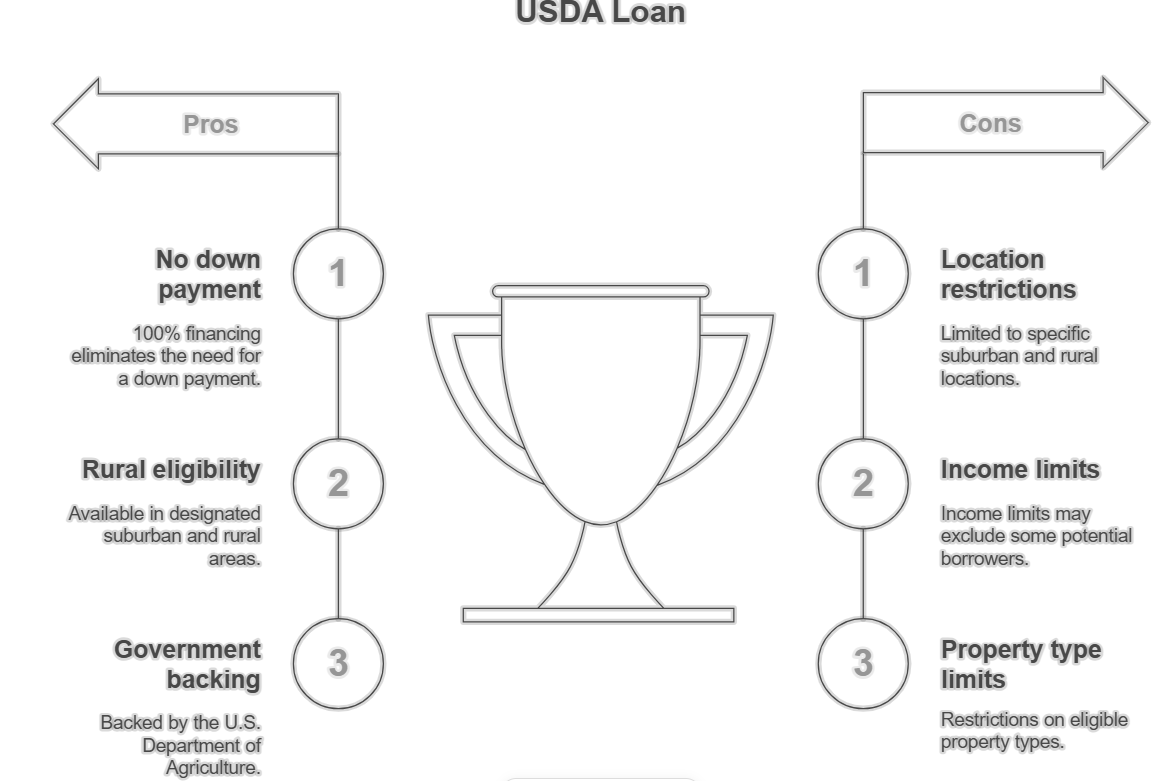

USDA loans, backed by the U.S. Department of Agriculture, offer 100% financing for eligible homebuyers in designated suburban and rural areas—making them a strong no down payment loan Indiana.

For those who fail to qualify, other forms of mortgage down payment assistance in Indiana can also help mitigate the gap to homeownership.

Buyers must meet income limits, which vary by region, and the property must be located in a USDA-designated area. A map is available on the USDA website to check eligibility.

To qualify for a USDA loan, buyers are required to meet income limits that differ by region, and the property should be located in a USDA-designated area. You can check eligibility through the interactive map available on the official USDA site.

The home must be safe and sound, with no significant repairs needed at the time of purchase. Homes built before 1978 may require lead-based paint inspections due to potential health risks.

These loans aren’t restricted to first-time homebuyers, making them accessible to seasoned buyers too. Also, they are more forgiving for those with comparatively higher debt-to-income ratios, that can be beneficial for buyers with existing financial obligations.

USDA loans are primarily advantageous for those looking to buy in less urbanized areas, bringing more homeownership opportunities to rural Indiana.

The HomeStart Program, provided by First Option Mortgage in Indianapolis, is a great initiative that offers up to 100% financing for eligible homebuyers—making it a standout option for no down payment loan Indiana, which eliminates the necessity for an upfront down payment.

The program is open to every qualifying buyer—not only the first-time homebuyers—though not every applicant will be eligible. Specific income or credit requirements are required to be met, so it’s crucial to check eligibility.

This program is an integral part of the zero-down mortgage options of First Option Mortgage’s, and it doesn’t involve any third-party company, streamlining the process. It’s noted for its accessibility as well as positive customer feedback, with a 4.9-star rating on Google based on 400+ reviews.

First Option Mortgage also partners with the USDA and IHCDA (Indiana Housing and Community Development Authority) for additional no down payment programs, including exciting options for veterans.

This program is appealing, especially for those looking for a local lender with a strong reputation, providing a direct pathway to zero down payment homeownership.

Check this comparison table to compare the key features of the no down payment loan Indiana and make more informed decisions –

| Loan Type | Down Payment | Eligibility | Property Requirements | Additional Notes |

| VA Mortgage | 0% | Veterans, active-duty military, survivors | Should pass VA appraisal, zero fixer-uppers | Responsible for closing costs, 100% negotiable |

| USDA Loan | 0% | Income limits, rural/suburban areas | Safe and sound, potential lead paint checks | Forgiving for higher debt-to-income |

| HomeStart (First Option) | 0% | All qualifying buyers, not everyone qualifies | Standard appraisal, varies by lender | Partners with USDA, IHCDA, veteran programs |

This chart sheds light on the diversity of options, each catering to multiple buyer profiles, from rural residents to veterans and general homebuyers.

While the options are the major no down payment solutions, other programs in Indiana—like FHA Loans in Indiana—provide down payment assistance that can help decrease, though not eliminate, the upfront cost. For completeness, these additional programs are outlined below –

IHCDA provides Next Home (3.5%) and First Step (6%) programs to reduce payments. While not zero down payment loans, they lower upfront costs. Visit IHCDA – Homebuyers for details.

Provided by FHLBank Indianapolis, the Launch Down Payment Assistance program helps with closing costs, down payments, and counselling for first-time buyers. It doesn’t provide complete financing; hence a partial down payment may still be required.

Local credit unions, like Navy Federal, might provide competitive low or zero down payment options, though terms differ. Looking into these specific institutions is recommended.

All these programs are crucial for a holistic understanding, though they cannot meet the strict definition of zero down payment loans.

Each program has specific criteria—such as income limits, property location, and credit scores. For example, USDA loans are for rural properties, while VA loans are for those with military service.

It’s important to check eligibility with the program administrator or lender, as terms may shift. A knowledgeable realtor or lender can help in streamlining the process and finding the best fit.

In Indiana, no down payment loans Indiana are exclusively available through USDA loans for rural areas, VA loans for veterans, and the HomeStart program for eligible homebuyers. Each has distinct perks and needs, so it’s crucial to consult with professionals and assess eligibility.

This guide provides a clear overview of these options to support informed homeownership decisions.