23-Jul-2025

Let’s face the truth – navigating the field of homeownership, especially the first-time homebuyer, comes with multiple numbers – and potential savings. Out of plenty of potential perks, claiming to fame in homeownership, mortgage interest tax deduction is certainly worth mentioning! This tax break can bring a significant reduction in your taxable income, especially if you match the right criteria.

Wondering how to estimate your savings? Don’t worry! You can seal the deal – without any hassle – using a mortgage tax deduction calculator. No matter if you are a new homeowner or looking to refinance, this tool will help you gain an accurate understanding of how much interest you might deduct depending on your rate, loan, and filing status. Dive in to learn how it works, who qualifies, and what kind of savings you could expect.

The mortgage interest tax deduction lets eligible homeowners subtract charges paid on approved home loans from their federal taxable earnings – potentially lowering what they owe the IRS.

This deduction can add up to a significant amount in annual tax savings – particularly throughout the early years of your mortgage.

A mortgage tax deduction calculator helps in simplifying the overall math by enabling you to estimate your deduction depending on your loan specifics. Wondering how it functions? Dive into the details below –

To get the most accurate estimate, a mortgage tax calculator will ask for the following –

Depending on your inputs, this tax calculator usually calculates –

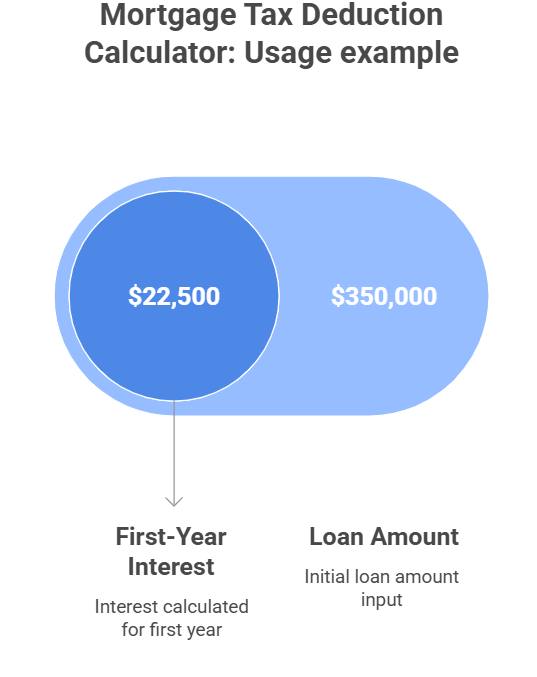

Suppose you enter the following details –

The calculator determines first-year interest of around $22,500, and then indicates to you if breaking down your deductions will save you more than just choosing the standard option.

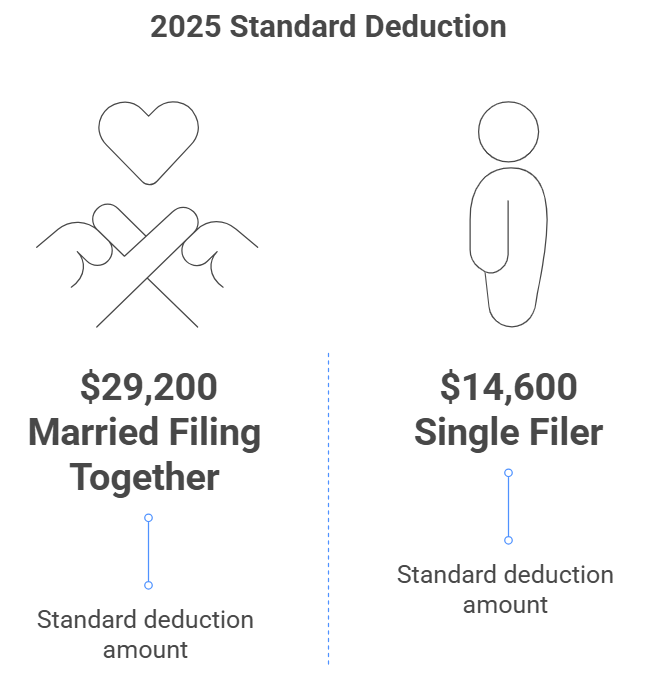

This is one of the most important questions! For 2025, the standard deduction is –

If your combined detailed deductions (property taxes, charitable donations, mortgage interest, etc.) go beyond these amounts, you will save more by listing them individually! Count on this calculator to compare both options – and contact a tax advisor if you lack certainty.

Here’s a quick sample breakdown –

| Detail | Amount |

| Home Loan | Around $350,000 |

| Interest Rate | Approximately 6.5% |

| First-Year Interest Paid | Around ~$22,500 |

| Filing Status | Married Filing Jointly |

| Standard Deduction | Around $29,200 |

| Other Deductions (State Tax) | Approximately $10,000 |

| Total Itemized Deductions | Around $32,500 |

| Tax Bracket | Approximately 22% |

| Tax Savings | Around $7,150 |

As the itemized amount surpasses the standard deduction, the taxpayers would gain by breaking down deductions – and save around $7,150 in federal taxes!

While this tax break is useful, there are specific limits to consider. The IRS sets maximum thresholds on the level of mortgage debt, which qualifies for interest deduction. Additionally, not every type of home loan or use of loan proceeds is recognized under current tax laws.

There’s no doubt in the fact that a mortgage-related tax deduction calculator is an effective tool, but it, too, has certain limitations. Keep them in mind before you rely on it –

Hence, these calculators are best suited for estimates – not final tax planning.

No. You must list deductions individually to claim mortgage interest.

It used to be, but the tax break has lapsed unless renewed by the federal lawmakers. Consult with a tax advisor for more accurate and genuine updates.

No, provided that the new financing is used for home improvement or acquisition reasons. Cash-out restructuring for other uses might be ineligible.

The importance of a mortgage tax relief calculator is paramount, especially for homeowners looking to boost their tax savings. Even though it doesn’t take the place of professional guidance, it helps you gain a thorough understanding of how mortgage interest impacts your taxes and if itemizing could actually pay off.

If your detailed deductions go beyond the standard tax allowance, don’t miss out on potential savings. Run your figures, check out your suitable options, and lighten your next tax burden!

So, are you ready to estimate your overall savings? Click here to try a Mortgage Tax Deduction Calculator for the best result! Just plug in your details and discover how you could slash your tax bill.

Pro tip – Upon using the calculator, ensure you talk to a qualified and experienced tax professional. Everyone has a unique financial situation – and customized advice can result in wiser decisions.