17-Jul-2025

Let’s face the truth – buying a house is stressful and challenging without having to decode terms such as “earnest money and down payment.” Even though they both involve upfront prices, they serve different roles in the process of home buying. Knowing the difference is important for making wise, confident, and informed decisions. But before we go any further, let’s quickly break down what earnest money is all about –

Earnest money refers to a deposit made by the buyers to show genuine interest while submitting a proposal on a property. Think of it as a financial signal – a sign that tells the seller, “Yes, I am serious and confident.”

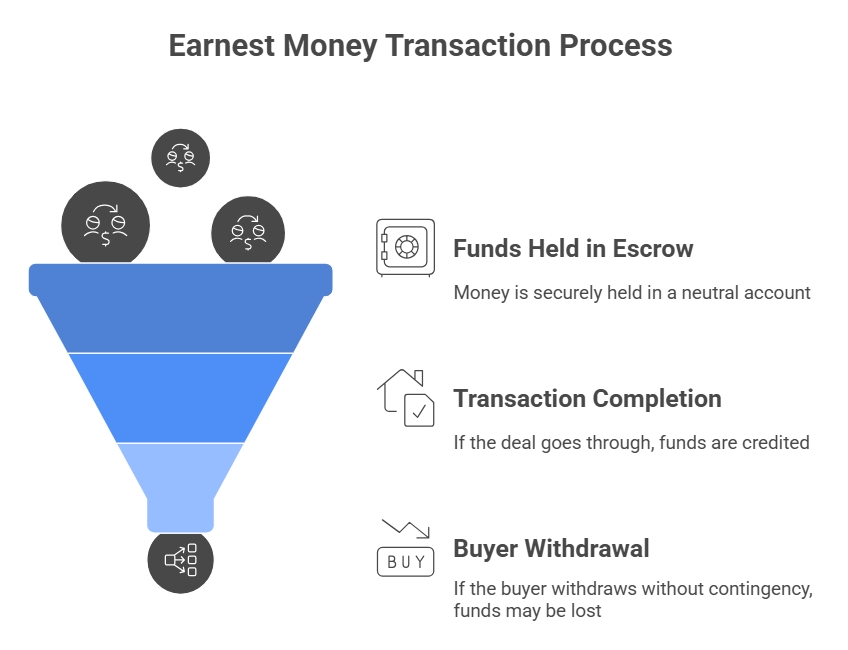

Here’s how the entire process unfolds –

Real-Life Example:

Suppose you’re buying a $300,000 home. You put down around $5,000 as earnest money to indicate you’re truly interested. The amount is held in a neutral account and later credited toward your settlement costs or down payment. However, if the transaction is done, the funds remain with you. But if you withdraw without any legitimate contingency, the seller may retain the $5,000! It shows how earnest money serves as a trust-based gesture – and why following contract terms is so paramount.

Also read: How Much Earnest Money Should You Put Down When Buying a Home?

A down payment is the portion of the overall purchase price of a home that the buyer pays in advance during the final settlement. Unlike earnest money, which is a sign of commitment, the down payment goes directly to the overall cost of the home.

A larger down payment lowers the lender’s exposure, which can lead to more favorable loan terms like lower interest rates. It also enhances your LTV (loan-to-value) ratio, which is an important factor in determining if you’ll need to pay PMI (private mortgage insurance).

For conventional loans, private mortgage insurance is mandatory if your initial payment contribution is below 20%, possibly adding $50 to $200 to your recurring payment on a $300,000 home.

Key facts to take into consideration –

In short, your down payment shows financial capability and reduces the lender’s risk.

In 2025, increasing home prices across many U.S. regions mean earnest money deposits are getting more aggressive. In high-demand areas, providing 3–5% can help your offer stand out.

At the same time, down payment requirements continue to allow flexibility, with options like VA and FHA VA loans helping homeowners enter the property space with reduced upfront expenses. Interest rates that have varied recently also affect affordability – talk to lenders to thoroughly understand how your upfront payment redefines your long-term mortgage payments.

Though both involve initial costs, earnest money and down payment comes into play at different stages and serve distinct objectives.

Here’s a quick comparison for better clarity –

| Feature | Earnest Money | Down Payment |

| Timing | At offer acceptance | At closing |

| Purpose | To secure the contract | Part of the purchase price of the home |

| Amount | 1–3% of purchase price (differs) | 3–20%+ of purchase price |

| Refundability | Often returnable under certain contract conditions. | Non-refundable |

| Held By | Title company or escrow agent | Paid to seller or lender at closing |

| Affects Loan? | No | Yes (decreases loan amount needed) |

This comparison illustrates how earnest money safeguards the transaction in its early stage, while the down payment finalizes your overall acquisition at closing.

These two payments align throughout the process of buying property.

Imagine you’re purchasing a $500,000 property and put up $10,000 as earnest money (2%) into a holding account. At settlement, your 10% down payment amounts to $50,000. As the $10,000 is applied, you’re required to pay around $40,000 at closing, along with any additional fees. This arrangement ensures your initial deposit forms part of your overall investment.

Let’s debunk a few myths concerning earnest money and initial buyer payments –

It’s untrue! The earnest money indicates a deposit to signal commitment; the down payment contributes to the total purchase price.

Absolutely wrong! If the contract includes specific conditions and you fulfil them, you typically get your earnest money refunded.

While a larger down payment helps, financial institutions also assess your credit history, financial obligation to income, and total earning consistency.

That’s a misconception – many loan options require as little as a 3% initial contribution.

Knowing the distinctions between an initial commitment deposit and a down payment helps you –

When buyers mix up the two, they might end up misinterpreting agreement details or mismanaging their funds – both of which could result in missed opportunities or delays.

Yes, it’s typically credited toward your closing costs or down payment.

Yes, especially if you miss deadlines or break the contract without any valid contingencies.

Usually 3% to 20%, although some loans might need none.

Usually a neutral third-party service provider, title company, or property attorney.

Grasping the role of earnest money & down payment helps you step into the home purchasing process with clarity and confidence. Even though they may appear alike, each serves a vital and distinct role in securing the deal and finalizing your home purchase.

Looking to buy the home of your dreams? If yes, then start by gaining an understanding of the numbers – as smart decisions result in smooth closings.