04-Apr-2025

Admit it or not, purchasing a home is a huge financial commitment. And, for many potential buyers in Indiana, one of the biggest challenges is mainly the down payment. To champion this challenge, a wide variety of down payment assistance Indiana-based programs are available at both local and state levels.

Providing financial aid – either as repayable or forgivable loans – these programs are aimed at making homeownership more accessible. The below-mentioned analysis, as of March 28, 2025, sheds light on the DPA (down payment assistance) landscape of Indiana, detailing different aspects like eligibility criteria, program structures, and associated advantages and disadvantages.

If you are a potential homebuyer, take the time to understand these programs thoroughly—as knowledge is power when it comes to making informed decisions and maximizing financial assistance.

The Indiana Housing and Community Development Authority (IHCDA) is the primary state agency providing DPA, with programs including Next Home and First Step. In addition to this, local initiatives in cities such as Evansville and Bloomington provide targeted assistance. Ahead is an in-depth look at these programs as per official sources as well as program guides.

As the name suggests, the First Step in down payment assistance Indiana-based program is tailored for those looking to buy a home for the first time. This step provides significant DPA with both FHA and Conventional versions. The in-depth and accurate guidelines are available in the IHCDA First Step FHA Guide and IHCDA First Step Conventional Guide.

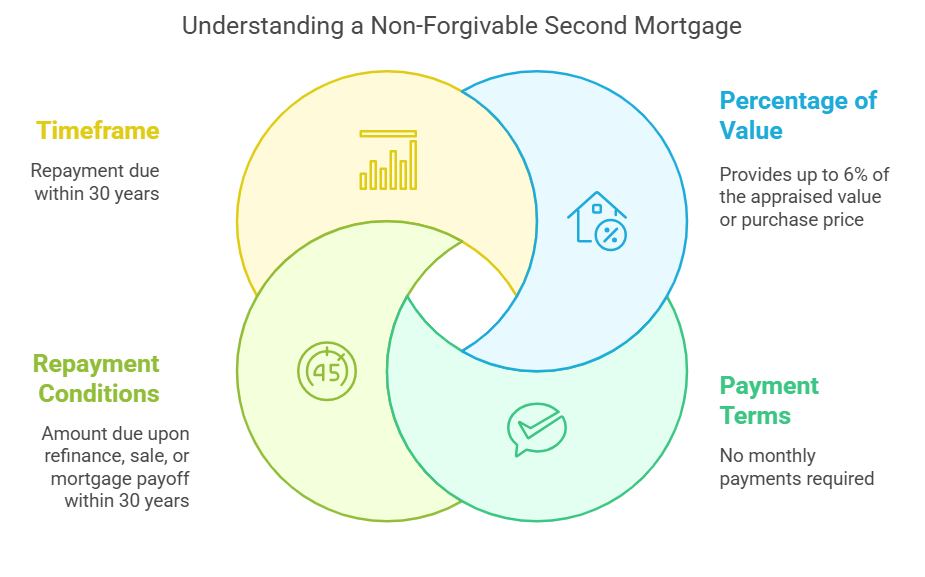

Provides up to 6% of the lesser of the appraised value or purchase price as a completely non-forgivable second mortgage. There’s no requirement for any monthly payment, but the amount is due open refinance, sale or mortgage payoff within 30 years.

Don’t forget to check your eligibility today and explore your suitable options!

The Next Home Program, available in both conventional and FHA options, is tailored for repeat buyers. You can draw the program details in the Next Home Conventional Guide and Next Home FHA Guide.

Offers up to 3.5% down payment assistance as a second mortgage with a period of 3-year affordability. The loan is due especially if the property is sold, refinanced, or no longer serves as the principal residence of the borrower within this period.

Make sure that you check your eligibility today and explore your options!

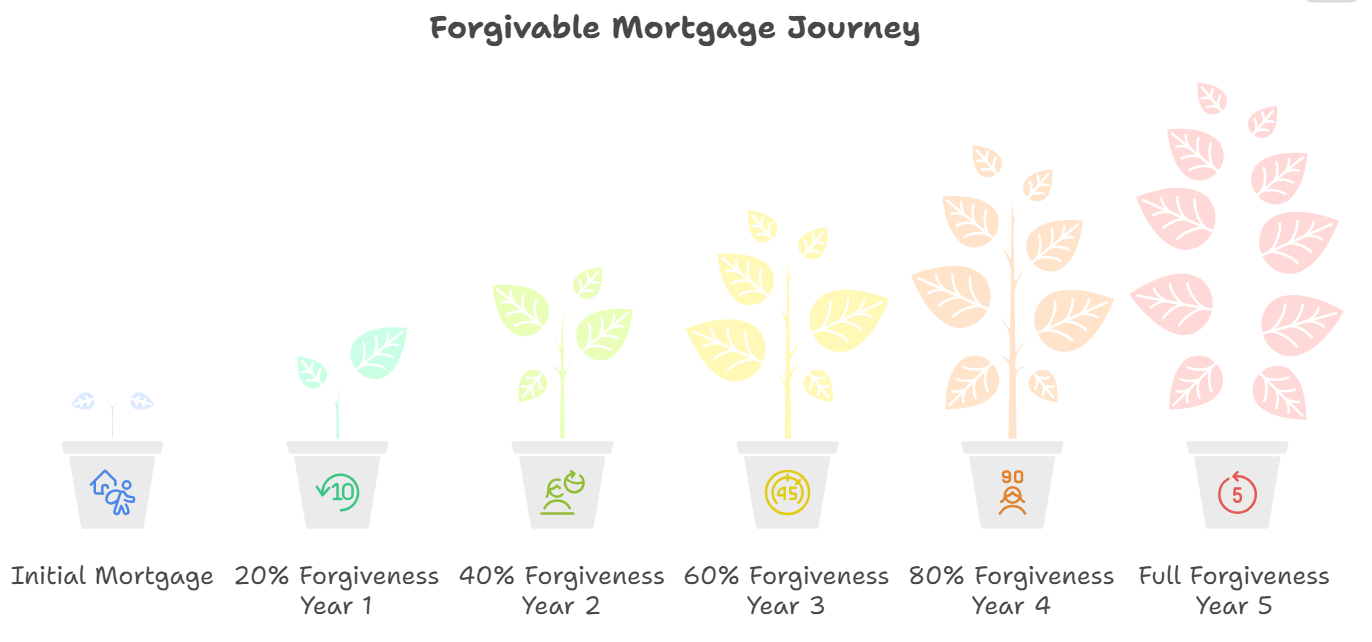

Local programs providing down payment assistance Indiana comes up with custom-tailored support through forgivable loan structures, although they are limited to specific geographic restrictions.

Check out the table below that summarizes the pros and cons of every program to improve decision-making –

| Program | Advantages | Disadvantages |

| IHCDA First Step | Up to 6% DPA, no monthly payments, waived first-time buyer requirement for some and flexible property types. | Non-forgivable, due upon sale/refinance, possible recapture tax, strict limits, fees. |

| IHCDA Next Home | Up to 3.5% DPA, no first-time buyer requirement, co-signers allowed, no tax transcripts needed. | Due if conditions not met within three years, fees, rate changes. |

| Bloomington HAND | Up to $10,000, fully forgivable over five years. | Requires owner-occupancy for five years, limited to Bloomington, income ≤80% AMI. |

| HOPE of Evansville | Up to $15,000 match, forgivable loan. | First-time buyer only, geographic restrictions, income and mortgage conditions apply. |

| United Way Wabash | Covers both down payment and closing costs. | Limited to specific counties, max $4,000 for higher-priced homes, likely income limits. |

| Hoosier Homes | Up to 6% DPA, forgivable over three years. | Requires owner-occupancy, income and price restrictions apply. |

The DPA programs of Indiana offer important financial assistance to both first-time as well as repeat homebuyers. While some offer forgivable loans, others need repayment under certain conditions. With median home prices at $259,900 (as of December 2024), these programs improve affordability. However, funding availability might differ, with potential waiting lists and annual updates.

For the latest updates, connect to program administrators or approved lenders. The IHCDA suggests reaching out through homeownership@ihcda.in.gov for assistance or guidance on evolving guidelines. A thorough understanding of these programs helps home-buyers leverage assistance to gain homeownership.