04-Apr-2025

The down payment assistance program in Illinois is incredibly robust, catering to a wide array of homebuyer needs through local and state initiatives. The down payment assistance in Illinois, as of April 2, 2025, offers an in-depth examination of each available program, their eligibility criteria, structures, advantages and drawbacks, ensuring a clear understanding for potential beneficiaries.

The IHDA (Illinois Housing Development Authority) is the main state agency providing down payment assistance (DPA) through programs such as IHDAccess Forgivable, Repayable, and Deferred.

In addition to this, local initiatives in cities like Chicago, Cook County, and Alton offer further support. The following excerpt highlights an in-depth look at each program, based on official program guides and sources, ensuring accuracy and authenticity.

To understand the down payment assistance Illinois better, you need to check out this analysis of IHDA programs. This program provides 3 major DPA options, that are discussed in detail at the IHDA Mortgage for homebuyers.

Loan Types: Available with conventional, FHA, USDA, or VA loans, 30-year fixed rate.

Eligibility: Same as Forgivable, with a higher assistance amount, ideal for buyers looking for larger upfront help. Check your eligibility today!

Eligibility: Same criteria, but needs monthly payments, ideal for buyers with capacity for daily repayment. Don’t forget to check eligibility!

Our discussion around down payment assistance in Illinois is incomplete without highlighting the local initiatives aimed at offering targeted assistance, often a higher amount but with certain geographical limitations.

To streamline the process of decision-making, we are presenting a table highlighting the advantages and disadvantages of every program pertaining to Down Payment Assistance Illinois, focusing on financial perks and potential challenges.

| Program | Advantages | Disadvantages |

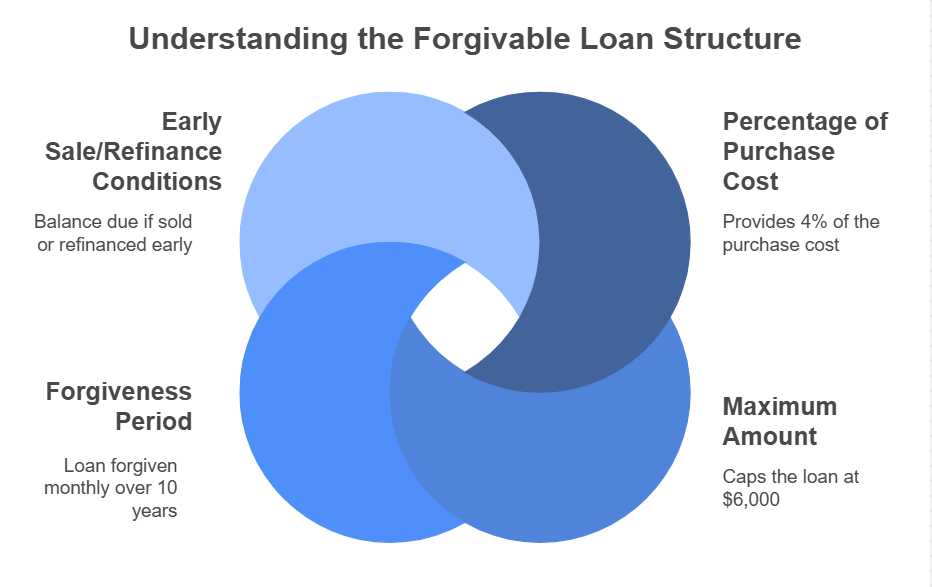

| IHD Access Forgivable | Forgivable over 10 years, no monthly payments, applies to all loan types | Lower amount ($6,000), must stay 10 years, income/purchase limits |

| IHD Access Deferred | Higher amount ($7,500), interest-free, deferred repayment | Due on sale/refinance, income/purchase limits |

| IHD Access Repayable | Highest amount ($10,000), interest-free, no prepayment penalty | Monthly payments for 10 years, income/purchase limits |

| CHA DPA | Up to $20,000 for residents, forgiven after 10 years | Chicago-only, first-time buyer only, off subsidy for residents |

| Cook County DPA | Up to $25,000, no income limit in some areas, for first/repeat buyers | Geographic restriction (Cook County), need education course |

| City of Alton Program | Forgivable after 5 years, low contribution ($1,000) | Limited to Alton, income and purchase limits, must secure loan first |

The average down payment is $32,645 in Illinois, as per the first-time homebuyer study by LendingTree, making Down Payment Assistance Illinois programs important for affordability. According to Down Payment Resource, 45 programs are available, with around 69% funded as of January 2025—providing a lot more options than many prospective buyers might expect.

Local programs, like the zero-income-restriction locations of Cook County in Disproportionately Impacted Areas, provide unmatched flexibility, thus expanding access. However, funding availability may fluctuate, and some programs might have annual updates or waiting lists.

For instance, the CHA program requires every resident to transition off subsidies, while Alton’s low $1,000 contribution requisite can streamline the entry process for some buyers. Prospective homebuyers are required to contact approved program administrators or lenders for the current updates, as program funding and terms may change.

These programs collectively resolve diverse requirements, from repeat purchasers to first-time buyers, with different levels of conditions and assistance. For example, the range of IHDA allows unparalleled flexibility, while local programs such as Cook County and CHA provide higher amounts but with territorial barriers.

Buyers must verify current availability, particularly with the 69% funding rate, and seize every opportunity to combine programs where possible.