20-May-2025

Down Payment Assistance also known as DPA are designed to help homebuyers in managing the upfront costs of buying a home – such as closing costs and as down payments. These programs are typically provided by nonprofit organizations, lenders or government agencies, and are especially useful for first-time purchasers or those with very limited savings.

Are you an aspiring homebuyer, too? Just like many, you, too, might be asking yourself, “can you use multiple down payment assistance programs?” The answer is mostly “yes” – but it depends on some specific guidelines of every program, your eligibility, and the lender’s policies.

It’s crucial to carefully review the requirements and consult with your housing counsellor or lender to understand how various programs could be combined.

To better navigate your homebuying journey, it’s crucial to first gain a thorough understanding of down payment assistance programs. All these programs come in multiple forms, including –

In case you are considering options such as down payment assistance in Indiana or anywhere else, it’s crucial to know that eligibility usually depends on factors like your credit score (often 620 or higher), debt-to-income ratio, income, and whether you’re a first-time homebuyer (defined as not having owned a house over the past 3 years).

Certain programs might also have restrictions depending on location, property type, or mortgage loan type (e.g., VA, FHA, or conventional). Prior to applying, check eligibility for every program to witness what complements your financial situation best—particularly if you’re wondering can you use different down payment assistance programs?

In multiple cases, the response is yes, based on your qualifications and the program guidelines.

Yes, in several cases, you can use a multiple number of DPA programs, a practice called “stacking.” However, it’s important to take the following factors into consideration –

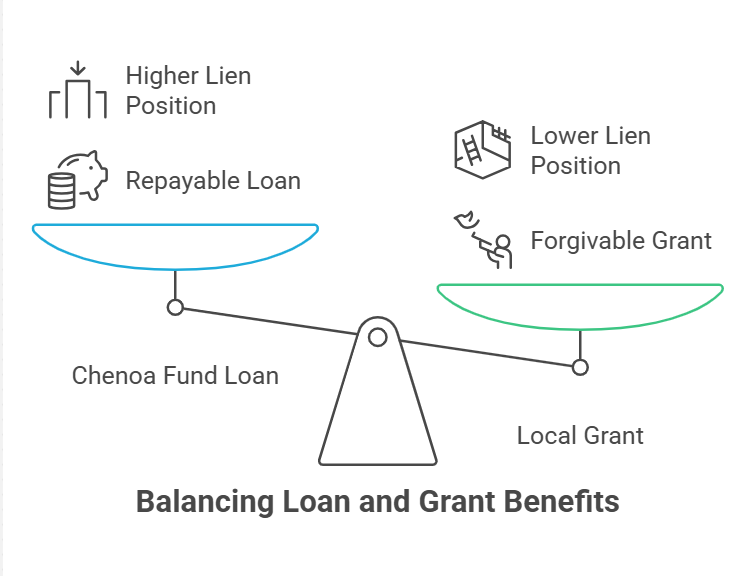

There are some DPA programs that allow stacking; others don’t. For instance, a grant might be combined with a forgivable loan, but two loans with liens can conflict because of lien priority. Consider reviewing the terms of each program.

Not every lender accepts a multitude of DPA sources. Compatibility depends on both kinds of mortgage (e.g., VA, FHA, conventional) and the lender is internal policies.

You should qualify for every program individually. Criteria can differ depending on credit score, income, profession (such as, first responders, teachers), and location.

Stacking might impact your LTV ratio. Lenders often cap overall assistance to keep the LTV within acceptable restrictions.

Using a number of programs may boost your financial obligations. For example, combining a repayable loan with a forgivable one may result in several payments or repayment upon early sale.

So, in a nutshell, when stacking is possible, success often depends on aligning lender policies, program rules, and your individual eligibility. Make sure to check eligibility and consult with your housing advisor or lender to plan things effectively.

The Chenoa Fund provides repayable or forgivable loans, which might be combined with local grants—provided the grant doesn’t take any higher lien position. For instance, a 5% Chenoa loan could be paired with a 4% local grant.

Agencies such as the CalHFA (California Housing Finance Agency) may allow a second mortgage to be combined with nonprofit or local grants, subject to eligibility.

This program provides up to $35,000 and might be stacked with local assistance, based on the lender’s approval.

Looking to see whether you qualify? Check Eligibility with a local housing authority or participating lender.

Below are mentioned some of the perks of stacking DPA programs –

Now, check out the potential drawbacks you can’t overlook –

If you’re exploring down payment assistance in Illinois or anywhere else, stacking programs can increase affordability—but always thoroughly review terms and talk to your lender for the suitable fit.

If you’re wondering how to effectively stack DPA programs, make sure that you check out the following guidelines –

Begin by exploring local options through the U.S. Department of HUD (Housing and Urban Development) website or search your city or state’s DPA programs. Tools such as Down Payment Resource can also help in identifying programs. If you’re asking yourself – “can you use multiple down payment assistance programs?” – this research is an effective first step.

Work with a professional loan officer experienced in local DPA programs. They can help identify stackable options and make sure that they perfectly align with your mortgage type. Many DPA programs need application through approved lenders.

Ensure that you meet the criteria for every program. Count on online tools—such as the TSAHC (Texas State Affordable Housing Corporation) quiz—or talk to your lender to check eligibility accurately.

Thoroughly review residency requirements, repayment rules, and any recapture clauses (i.e., repayment in case you sell too soon). Consider comparing grants versus loans to strike the right balance of obligation and flexibility.

DPA approvals can consume ample time. Embark on the application process as early as possible, and gather documents like pay stubs, bank statements, and W-2s to avoid delays in closing.

Stacking DPA programs can be a highly effective strategy – just make sure that you thoroughly understand the terms and check eligibility to explore the option successfully.

To see what you qualify for, you must check eligibility with a housing authority or local lender.

So, can you really use a multiple number of down payment assistance programs? Often, yes—but it majorly depends on lender requirements, program rules, and your financial profile. Stacking DPA programs can decrease upfront homebuying costs, but it needs careful planning. Begin by thoroughly researching local options and talking to a trusted lender.

So, are you ready to start? Check Eligibility and explore all the programs available in your area!