29-Apr-2025

Buying a home in Illinois is a big milestone—congrats on taking that big step!

For almost every prospective homeowner, one common query often arises – “how much do I need for home loan and down payment Illinois?” Whether you’re looking to buy a home for the first time or move to a quainter area in downstate Illinois, it’s important to have a thorough understanding of your options.

Exploring the different options for home loan and down payment in Illinois can help you navigate the process with confidence and move into your dream abode without any unnecessary financial stress.

To help you secure the finest deal, we’ve put together a comprehensive guideline to down payment assistance program in Indiana. However, before we introduce you to those details, it’s crucial to first understand the ‘basics’ of a home loan. Read –

Home loans – or mortgages – refer to financial tools, which help individuals buy property by borrowing money, with the property itself serving as collateral. The down payment required in Illinois differs by loan type.

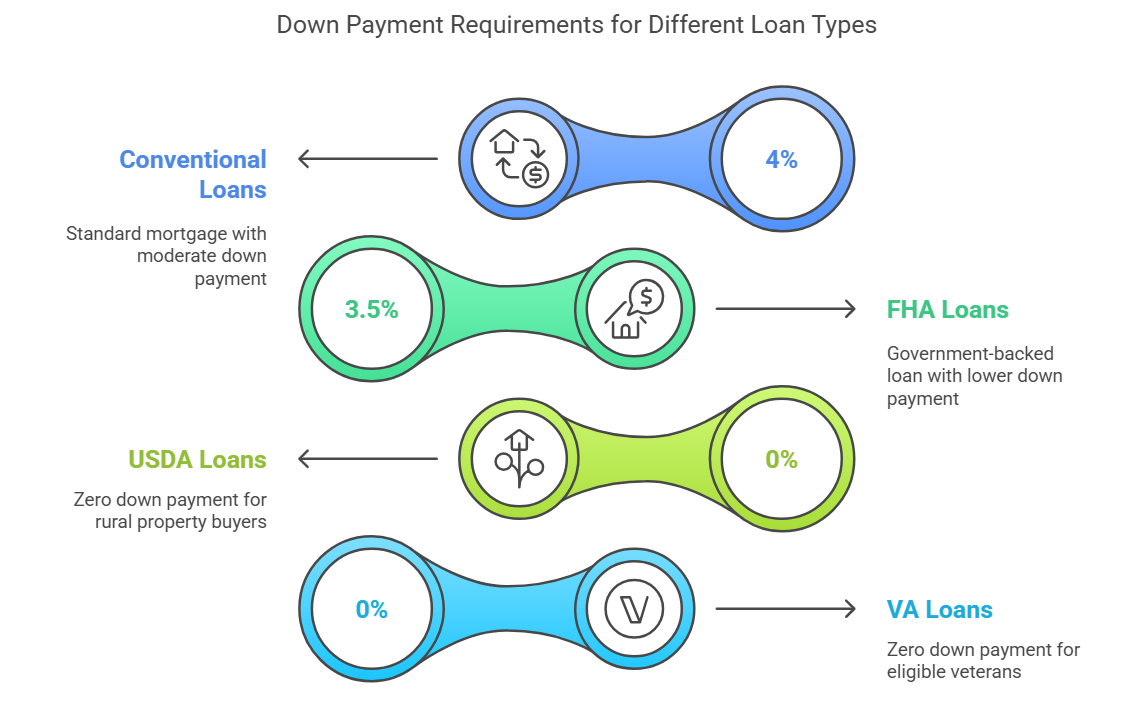

Conventional loans usually need up to 3% to 5% down, FHA loans in Illinois require at least 3.5%, while USDA and VA loans often need zero down payment—perfect for eligible buyers such as veterans or those in rural areas.

This range of options lays emphasis on the need to pick a loan that aligns with your financial goals. As highlighted by Northside Legal, these are basic standards in Illinois. For those looking for a no down payment loan Illinois, USDA and VA loans offer accessible pathways to homeownership without a big upfront cost.

Down payment assistance in Illinois has an important role to play in streamlining the path to homeownership, where financial conditions differ extensively. Here’s a quick look at key programs, beginning with those provided by the IHDA (Illinois Housing Development Authority) and Cook County.

The IHDA has several statewide DPA (down payment assistance) options to offer to help buyers lower upfront costs. Interested applicants must check eligibility prior to applying –

Cook County also provides local assistance for eligible homebuyers. These initiatives are beneficial useful for first-time homeowners looking to settle in the region. Make sure that you check eligibility through county resources or local housing agencies.

The down payment assistance programs of IHDA support different loan types, including VA, USDA, FHA, and others, with 30-year competitive terms and fixed rates. Available to repeat and first-time buyers with a minimum credit score of 640, they cover both new and existing homes within any income and price limits.

The Access Repayable option needs a minimum homeownership education, buyer contribution, and pre-purchase counselling. IHDA has helped fund more than $190 million in home loans, extending access to cost-effective homeownership across Illinois.

If you’re exploring your options for a home loan and down payment Illinois, these programs are a perfect place to start.

In addition to IHDA as well as Cook County initiatives, multiple other programs offer valuable mortgage down payment assistance Illinois.

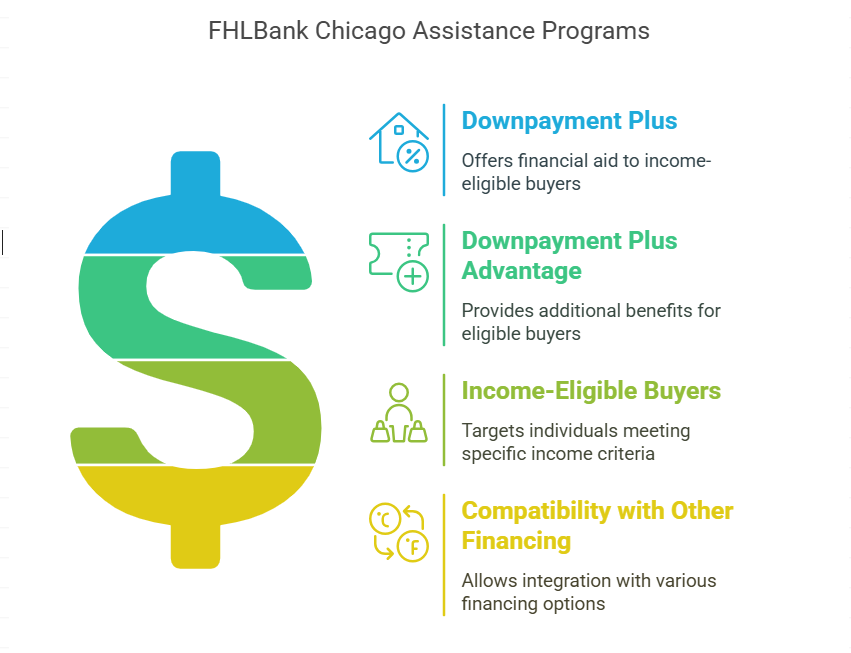

The FHLBank Chicago provides around $15,000 in assistance through its Down payment Plus and Down payment Plus Advantage programs, which are available to income-eligible buyers and have compatibility with other financing options.

Also, the Neighborhood Housing Services of Chicago supports homebuyers through grants of around $30,000 for closing costs and down payment, especially benefiting low- to moderate-income households in urban areas.

These programs extend access to homeownership across the state. Interested homebuyers are required to check eligibility to reap the dividends of available resources.

To support more informed and wise decision-making, the following chart provides a side-by-side comparison of keystone features from different home loan and down payment Illinois programs, aiding buyers in evaluating which option best suits their financial requirements and eligibility.

Each potential homeowner is encouraged to thoroughly check eligibility for every program before applying –

| Programs | Maximum Assistance | Eligibility | Repayment Terms | Additional Needs |

| IHDA Access Forgivable | Up to $6,000 | Statewide, credit score ≥ 640 | Forgiven over 10 years, zero payment | Homeownership education, primary residence |

| IHDA Access Deferred | Up to $7,500 | Statewide, credit score ≥ 640 | Deferred until sale/refinance/payoff | Same as above |

| IHDA Access Repayable | Up to $10,000 | Statewide, credit score ≥ 640 | Repaid monthly over 10 years | Contribute $1000/1%, education |

| Cook County DPA | Up to $25,000 or 5% | Cook County, income score ≥ 120% median | Zero payment (grant) | 8-hour education course |

| FHLBank Chicago DPP | Up to $15,000 | Income-eligible, not only first-time | Differs by program | Depends on lender partnership |

| NHS Chicago | Up to $30,000 | Chicago residents, eligibly differs | Grant, zero payment | Application through NLS |

This chart, based on program details, sheds light on the variety of available options—showcasing that while NHS and Cook County provide higher maximum assistance amounts, IHDA shines for its flexible repayment terms.

Illinois provides unhindered support for homebuyers through different down payment assistance programs, with IHDA addressing statewide requirements and Cook County targeting local affordability. Programs including NHS Chicago and FHLBank Chicago expand options, especially for urban and income-eligible buyers.

Potential buyers should assess their eligibility for home loan and down payment Illinois options, considering factors such as income, location, and credit score, and take the necessary homebuyer education to boost benefits.