25-Apr-2025

Buying a home in Indiana is a dream for many—and if you’re one such aspiring buyer gearing up to turn that dream into a reality, congrats! It’s an exciting moment, filled with anticipation and possibilities.

But alongside the excitement, it’s natural to feel a bit emotionally strained too—especially when you’re navigating important steps like home loan and down payment Indiana requirements.

Questions about upfront costs, financing, and what’s really needed of you could pile up instantly. If you’re feeling a mixed bag of anxiety and curiosity, you’re certainly not alone.

The good news? You have come to the right place. We have put together an easy-to-follow, clear guideline to help you navigate the whole process with confidence. Whether you are starting to explore your options or are all set to take the plunge, this down payment assistance in Indiana will guide you each step along the way.

Backed by a mortgage or home loan, you can purchase a home by borrowing money from a lender and paying it back over time with interest. The down payment is the initial amount you pay, which reduces the loan and shows your financial commitment.

In Indiana, down payments can start as low as 3.5% for FHA loans, with higher amounts for conventional loans. However, if you’re looking to minimize upfront costs, there are also no down payment loan Indiana options available, along with various assistance programs, particularly for first-time buyers.

For additional support, you can explore mortgage down payment assistance Indiana programs to reduce your financial burden.

Indiana provides multiple options for home loan, each with various down payment requirements –

Backed by the HUD (Housing and Urban Development) of the U.S. department, FHA loans in Indiana are a highly popular choice for first-time homebuyers. As of 2025, they need up to 3.5% down payment for borrowers with a credit score of 580 or even higher.

Those with scores between 500 and 579 might still qualify with around a 10% down payment, subject to lender approval. FHA loans in Indiana are restricted to primary residences and are subject to location-centric loan limits.

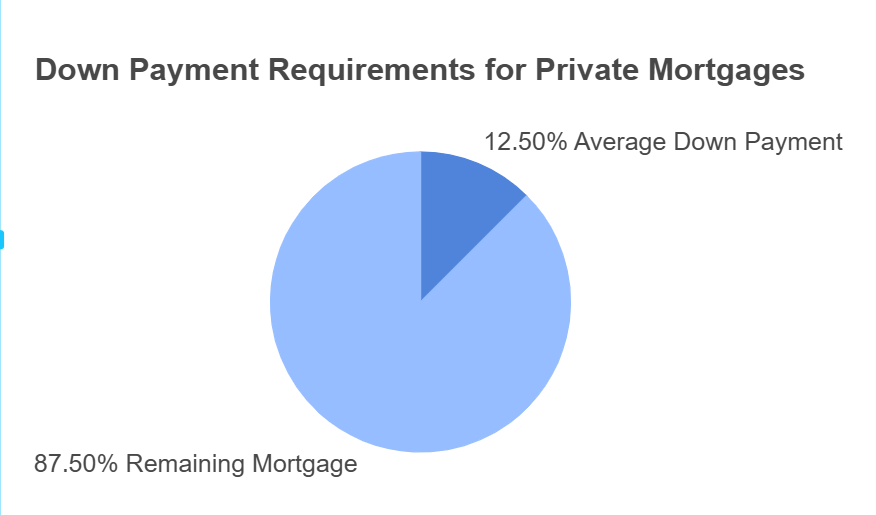

Provided by private lenders, these typically need around 5–20% down. Zero mortgage insurance is required in case you put down at least 20%. They are suitable for buyers with solid credit.

Available to eligible veterans as well as rural buyers, these loans often need no down payment, making them perfect low-cost options even though they are not exclusive to Indiana.

The IHCDA provides different homeownership programs with various down payment assistance options, eligibility criteria, and loan types. Make sure that you check eligibility to find the program that suits your needs.

| Program | Down Payment Assistance (DPA) Details | Types of Loan | Reservation Fee |

| First Step | Non-Forgivable DPA | FHA or Conventional | $250 |

| Next Home | 2.50% or 3.50% of purchase cost, not to go beyond appraised value | FHA or Conventional | Not specified |

| Next Step | Non-Forgivable DPA | FHA or Conventional | $250 |

Provides up to 6% of the home’s purchase cost as a forgivable second mortgage—zero repayment needed if the home isn’t refinanced or sold within 9 years. Available for conventional and FHA loans with a nominal credit score of 640. Primarily for first-time buyers, though exceptions may apply for veterans and purchases in specific areas. Home price limits differ by county.

Offers up to 3.5% down payment assistance for FHA loans as a second mortgage that should be repaid if the house is refinanced, foreclosed on sold at the period of forgiveness. Open to repeat and first-time buyers who meet credit (640+) and income requirements. Income limits differ by household and county size. Some IHCDA programs might include around $100 non-refundable reservation fee.

Beyond IHCDA, multiple other programs offer DPA (down payment assistance) across the state, extending options for those exploring different opportunities pertaining to home loan and down payment Indiana.

It provides forgivable loans to help with down payment, principal reduction, and closing costs. While the optimum assistance amount isn’t specified, this program is part of broader FHA down payment assistance grants, as outlined in the FHA down payment guide.

Offers around $5,000 to assist with fees, down payment, and closing prices, enabling eligible households to cover upfront homebuying costs. This assistance and guidelines are referenced in FHA-related resources for Indiana, widely available through FHA Grants Indiana.

Eligibility for such programs is based on a slew of factors including, credit score, location and income, that can differ by program. If you’re exploring home loan and down payment Indiana options, it’s crucial to thoroughly review every program’s specific needs –

A first-time homebuyer is usually defined as someone who hasn’t owned a prime residence in the past 3 years. However, exceptions might apply for buyers and military veterans in designated intended areas. For instance, programs such as First Place are mainly for first-time homebuyers but repeat purchasers may also qualify under specific conditions. Be sure to check eligibility to confirm the requirements.

Most of the IHCDA programs have income limits, which differ by household and county size. For instance, the Next Home program needs applicants to meet specific income guidelines, usually aimed to support moderate- to low-income buyers. Make sure that you check eligibility to confirm the requirements.

Most programs, including First Place and Next Home, need a very minimum credit score of 640. FHA loans might accept lower scores—as low as 500—if the purchaser can offer a 10% down payment, although this is subject to lender approval. Ensure that you check eligibility to confirm the requirements.

Eligible properties usually include townhouses, single-family homes, manufactured homes, and condominiums. Most programs need the property to be used as the buyer’s main residence. Be sure to check eligibility to confirm the requirements.

To apply for the homebuyer programs, a potential buyer must –

Review detailed program guidelines and eligibility criteria, considering some guides are under review. Connect to the relevant authority for the latest information.

For FHA loans, consider using the online application tool or consulting a professional FHA-approved lender.

Look into the list of participating lenders for further guideline or assistance.

For several other programs, you can directly reach out to the provider for specific application details.

Housing programs can alter frequently, so it’s crucial to thoroughly verify the latest details. A mortgage lender can help in identifying the best program depending on your goals and finances. Also, many programs allow the use of down payment assistance or gifted funds, minimizing upfront costs for homebuyers.