17-Apr-2025

If you want to understand mortgage down payments Illinois in detail, you’ve come to the right place. As of April 14, 2025, this comprehensive guide explores how the Illinois’s landscape of mortgage down payments is defined by state-specific assistance programs, evolving market trends, and individual financial circumstances.

We’ll dive into available options for down payment assistance, median down payment expectations, practical considerations for homebuyers, and key eligibility criteria. No matter if you’re a first-time buyer or navigating your options, this overview will help you make more informed decisions—and guide you on how to check eligibility for the programs that will suit your needs.

As per the 2024 study of LendingTree, the median mortgage down payment Illinois is approximately $32,645. This perfectly aligns with a median home sale price of around $280,000 in December 2024, as reported by TheMortgageReports, reflecting a down payment range of around 10–15%.

Even though a bit higher than the national median of around $26,700, Illinois’s down payment suggests higher upfront costs likely because of increasing home prices.

A down payment refers to the upfront amount a homebuyer needs to pay, minimizing the loan total and often reducing monthly payments and interest rates. It’s usually a percentage of the home’s overall price, with the following benchmarks –

In Illinois, the size of down payment affects the loan-to-value ratio, impacting both PMI requirements and interest rates. For instance, approximately 20% down on around $280,000 home equals $56,000, while up to 3% is $8,400 but needs PMI.

For buyers looking for help, down payment assistance in Illinois is available through local and state programs, making homeownership a lot more attainable.

The requirements of down payment differ by different types of loans, providing flexibility for various buyer profiles –

These types of loans, especially VA loans and FHA Loans in Illinois, offer accessible ways to homeownership with lower upfront costs.

The IHDA (Illinois Housing Development Authority) provides various down payment assistance programs, tailored to minimize upfront homebuying costs. These programs could be combined with conventional or FHA loans and widely available statewide across 102 counties.

Such programs need a minimum borrower contribution of up to $1,000 or 1% of the overall purchase cost, whichever is greater. As per The Mortgage Reports, such options significantly boost accessibility and affordability for homebuyers across Illinois.

To get access to the mortgage down payment Illinois assistance through the IHDA, borrowers should meet the below-mentioned general eligibility requirements –

A minimum credit score of up to 640 is needed, using the middle score (or lowest if fewer than 3 scores are available).

Should be situated anywhere within the State of Illinois.

Should fall within the latest limits of IHDA that can be found at ihdamortgage.org/limitsarchived

Around $1,000 or at least 1% of the home’s purchase cost—whichever is greater. This could also include appraisal fees, prepaid homeowners’ insurance, earnest money, and, in certain cases, gift funds (check with your loan officer when you check eligibility).

The home should be occupied as your primary residence within a span of 60 days of closing. Both repeat and first-time homebuyers are eligible, but current homeowners should verify their eligibility by a loan officer in case they own another property. Check eligibility to be on the safe side!

As of January 2025, Illinois provides 45 down payment assistance programs, with around 69% having available funding, as per LendingTree and Down Payment Resource. These include both state-level and local options, offering flexibility for buyers.

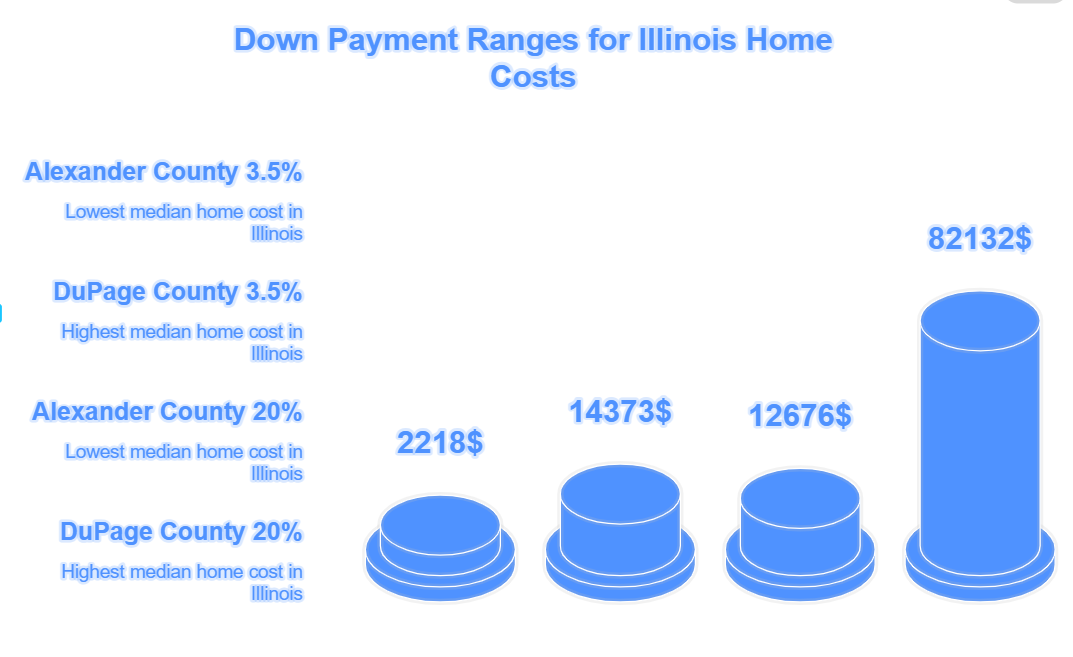

Median home costs in Illinois range from approximately $63,380 in Alexander County to up to $410,660 in DuPage County. This variation can impact the overall sdown payment amounts, with around 3.5% down payment ranging from $2,218 to $14,373, and up to 20% down payment from $12,676 to $82,132.

PMI (Private mortgage insurance) is typically needed for down payments under 20%, costing around $115 for a 15-year mortgage and up to $117 for a 30-year mortgage in Illinois. Illinois’ property tax rate of 2.08%, the second highest in the U.S., contributes further to housing costs.

To assist with accurate and informed decision-making, we present a chart summarizing the advantages and disadvantages of IHDA programs, focusing on the financial perks and potential setbacks of these options for mortgage down payment Illinois –

| Programs | Advantages | Drawbacks |

| IHDAccess Forgivable | Around $6,000, forgivable over 10 years, zero monthly payments | Non-forgivable, due on sale/refinance, recapture tax possible, strict limits, fees, zero e-signatures. |

| IHCDA First Step | Around 6% DPA, zero monthly payments, waived first-time buyer for some, flexible property types, education offered. | Due within 3 years if conditions not fulfilled, fees, strict limits, can’t fund DPA at closing, rate changes. |

| Bloomington HAND | Approximately $10,000, forgivable over 5 years, particular to first-time buyers in Bloomington. | Should remain owner-occupied 5 years, income ≤80% AMI, geographic limitation. |

| HOPE of Evansville | Around $15,000 match, forgivable, specific to Evansville first-time buyers. | First-time buyer only, geographic limitation, income and mortgage conditions. |

| United Way Wabash Valley | Approximately 5% or $4,000, covers down payment and closing, specific counties. | Restricted to specific counties, max $4,000 for higher-priced homes, likely income limits. |

| Hoosier Homes (Marion) | Around 6% DPA, forgivable over 3 years, specific income and price limits. | Should remain owner-occupied 3 years, price and income restrictions, other criteria. |

Home prices in Illinois increased up to 4.5% from October 2023 to October 2024, with areas such as Lake County-Kenosha County seeing around 8.2% hike, suggesting higher down payment requirements. The option to use gift funds for down payments can streamline the process, shocking some buyers anticipating stricter rules.

As of January 2025, around 69% of IHDA program funding is available, but a waiting list might exist. Buyers are required to verify the latest terms with lenders, as program and rate details could vary, especially by April 14, 2025.

Mortgage down payments Illinois, with a median of up to $32,645, reflect the housing market dynamics of the state. Through IHDA and many other programs, homebuyers can lower upfront costs, resolving diverse requirements from first-time purchasers to repeat buyers.

Buyers must thoroughly verify current availability, given the 69% funding rate, and combine programs whenever possible to conquer their homeownership milestones.