11-Apr-2025

The landscape of mortgage down payment Indiana is shaped and heavily influenced by state-specific assistance programs, individual financial circumstances, and the latest market trends. A down payment refers to the initial amount a buyer pays while buying a home—typically a percentage of the overall purchase price.

This upfront payment lowers the overall loan amount, can reduce monthly payments and interest rates, and might eliminate the need for private mortgage insurance (PMI) if 20% or more is paid.

Are you looking for expert down payment assistance in Indiana? If yes, then read this analysis to get a comprehensive overview of eligibility requirements, median down payments, key practical considerations and available assistance programs – offering prospective homebuyers with accurate insights required to navigate their options effectively.

Don’t forget to check eligibility to ensure you qualify for the programs that best meet your needs.

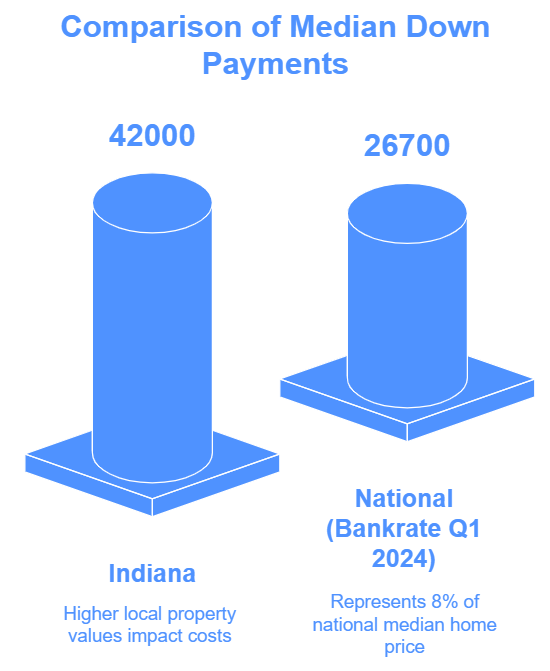

As per the recent ATTOM data from September 2024, as reported by MoneyGeek, the median mortgage down payment Indiana homebuyers make is around $42,000. This figure displays key dynamics in the housing market of the state, where the median home sale price reached approximately $259,900 in December 2024, as per the data from TheMortgageReports.

Typically, the median down payment accounts for around 10–15% of the purchase price of a home, aligning with national trends, although it may fluctuate by county and individual buyer profile.

For context, Indiana’s median down payment of around $42,000 is a lot higher than some national estimates—like Bankrate’s Q1 2024 national median of $26,700 that represented roughly 8% of a $335,500 home purchase price. This suggests that Indiana-based homebuyers might face steeper upfront costs, potentially because of the localized increases in property values.

Nevertheless, the $42,000 figure aligns perfectly with MoneyGeek’s analysis that counts on updated, accurate data from ATTOM, a top provider of real estate statistics.

A down payment refers to the initial amount a homebuyer needs to pay while buying a property. This payment lowers the overall amount of the loan and can potentially reduce both monthly mortgage payments and interest rates.

Down payments are usually expressed as a percentage of the purchase price of a home, with multiple common benchmarks –

In Indiana, the amount of the down payment directly impacts the LTV (loan-to-value) ratio, which as a result influences interest rates and whether PMI is required. For instance, on an approximately $259,900 home—the median sale price of the state as of late 2024—around 20% down payment would amount to $51,980, aligning with the median down payment range of Indiana.

In contrast, around 3% down payment would be only $7,797, a much lower upfront price but one that would need PMI and potentially come with higher interest rates.

The IHCDA (Indiana Housing and Community Development Authority) comes up with a few down payment assistance programs, discussed in detail on their website to help minimize upfront homebuying costs. These programs are often combined with FHA or conventional loans –

Available across 92 counties, all these IHCDA programs expand access to homeownership for Hoosier families via targeted support and fixed-rate financing.

In addition to the statewide initiatives, multiple local programs across Indiana come up with targeted down payment assistance. While often restricted to certain geographic areas, these programs might offer higher support amounts and unique perks –

These local programs improve affordability and flexibility for the Indiana-based homebuyers. For instance, the fully forgivable assistance of Bloomington over 5 years can significantly minimize the long-term financial complications compared to different non-forgivable state-level options.

To qualify for the IHCDA programs, borrowers are required the followings –

To apply for the same, you need to –

For the local programs, get in touch with the administering organization, such as Bloomington’s HAND or HOPE of Evansville, for the specific application details.

Also, make sure that you check eligibility before moving forward with the process.

To aid decision-making, here’s a table summarizing the advantages and drawbacks of the key programs, highlighting the major financial perks and potential setbacks –

| Program | Pros | Cons |

| IHCDA First Step |

Around 6% DPA, zero monthly payments, waived first-time buyer for some, flexible property types, education offered. |

Non-forgivable, due on sale/refinance, recapture tax possible, strict limits, fees, and no e-signatures. |

| IHCDA Next Home | Around 3.5% DPA, no first-time buyer needs, co-signers allowed, zero tax transcripts needed, lender compensation. | Due within a span of 3 years if the basic conditions not met, fees, strict limits, can’t fund DPA at closing, rate changes. |

| Bloomington HAND | Around $10,000, forgivable over a span of 5 years, specific to the first-time buyers in Bloomington. | Should remain owner-occupied 5 years, income ≤80% AMI, and geographic limitation. |

| HOPE of Evansville | Around $15,000 match, forgivable, specific to the first-time buyers of Evansville. | First-time buyer only, geographic limitation, income and mortgage conditions. |

This table sheds light on the balance between requirements and accessibility, non-negotiable for the Indiana-based borrowers.

As of December 2024, the median home price in Indiana is approximately $259,900—well within the FHA loan limit of up to $524,225—making DPA (down payment assistance) crucial for affordability. According to Down Payment Resource, around 45 DPA programs are widely available in the state, with 69% funded as of January 2025, providing more options than many buyers may expect.

Programs such as Bloomington HAND provide forgivable loans, lowering long-term costs, while IHCDA offers non-forgivable assistance, which should be repaid upon sale—something to take into consideration while planning financially.

Funding and program details can alter, with certain programs subject to waiting lists or annual updates. For example, the Next Step Program, anticipated in early 2024, turns out to be a refinance option and isn’t incorporated here.

Buyers must contact approved program administrators or lenders to check current availability and eligibility, as terms for the mortgage down payment Indiana programs might shift over time.

Mortgage down payments in Indiana average approximately $42,000, reflecting the housing market conditions of the state. Programs provided by IHCDA as well as local agencies can help lower these upfront costs, supporting both repeat and first-time buyers.

With up to 69% of programs currently funded, buyers must verify availability and explore combining options to conquer their homeownership milestones more effectively.