22-Jul-2025

Are you a first-time homebuyer who’s excited to move into a new place but confused about real estate jargon? Terms like mortgage, down payment and escrow can be perplexing, but if you’re wondering whether your earnest money will go towards down payment, you’re already way ahead of the crowd. So, while you’re knee-deep in listings, googling mortgage rates, and negotiating the best offer, let us breakdown the truth behind earnest money and if it goes towards your down payment.

In this blog, we’ll unpack what earnest money is, deconstruct whether it goes towards down payment, and make you confident enough to make the best financial decision towards welcoming your dream home.

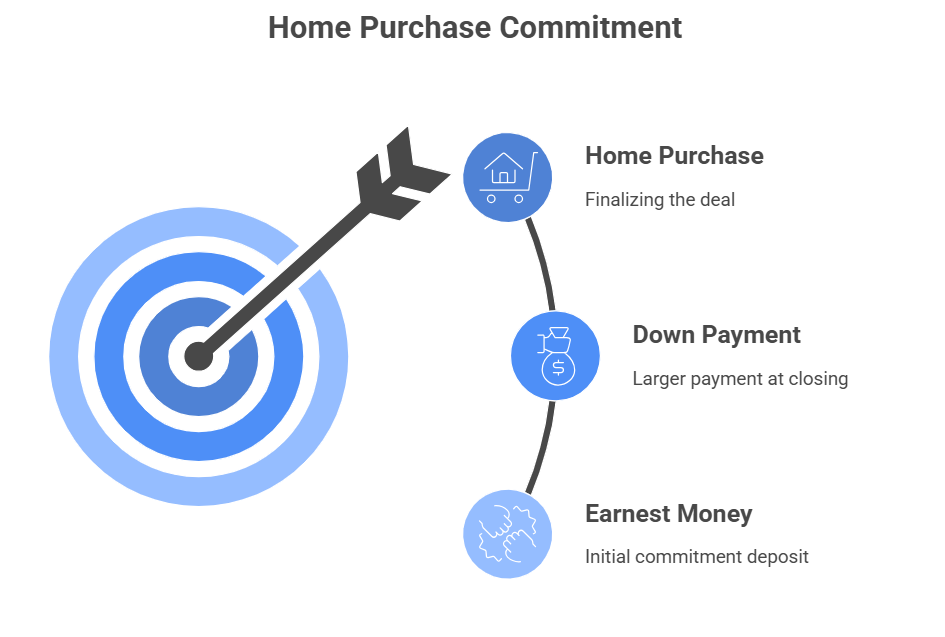

If you’re stuck wondering, what is earnest money?, don’t worry – you’re not the only one. Being new to real estate can be challenging, especially with the complicated terms. Understanding earnest money is easy – in simple terms, it is the deposit made by the buyer when purchasing their home as a sign of good faith. In contrast, a down payment is typically the money paid upfront by the buyer when making a large transaction, such as purchasing a house. To know more about more key differences between earnest money and down payment, click here.

If you want to show your seller that you’re serious about buying the home and committed to it, offering earnest money, which typically ranges from 1% to 3% of the purchase price (or even more, in highly competitive markets) is the best way forward. A down payment however, comes towards the end of closing the deal and is a larger % of the total purchasing price of your home.

Before making a financial commitment as big as buying a home, it is only fair to wonder if your earnest money will end up being a part of your down payment. Let’s find out.

Yes, you read that right! Your earnest money can potentially go towards your down payment. After you have solidified your commitment to purchasing the house, made an agreement in writing, and processed the deposit of your earnest money, it is held in an escrow account until the deal for your home is formally completed. Thereafter, your earnest money is “refunded” back to you by going towards your final closing deal, including playing an eminent role in meeting your down payment.

For example, suppose you found the home of your dreams for $300,000 and you’re committed to buying it. To let your seller know that you’re serious about the transaction, you deposit an earnest money worth $5000 in an escrow fund after a written agreement of purchase. When the deal is ultimately closed, instead of making a down payment of supposedly $30,000, you’ll only have to pay $25,000 as the $5000 from the earnest money deposited in the escrow fund will be transferred towards the final costs for down payment.

Simply knowing about earnest money and down payment isn’t enough – to make the best financial decisions. One needs to familiarize themselves with the processes involved with their money for the best results.

Ideally, your earnest money that demonstrates interest is stored in an escrow account and handled by a neutral third-party such as a real estate brokerage, an attorney or a title company. Upon finalizing the deal, your earnest money deposit is released from the escrow fund and adjusted with either your closing costs or the total amount of down payment.

Your earnest money thus serves a dual role; it secures your dream home from slipping out of your hands by showing intent to the seller while also reducing the financial obligations towards the closing through adjustments with the down payment.

Did your deal of buying a home fall through? If your purchase is cancelled due to unmet contingencies such as loan approval problems or a failed home inspection, the seller should refund the entirety of your earnest money. Make sure to include contingencies as a part of your purchase agreement before depositing the earnest money to ensure a secure transaction and refund.

However, if you decide to back away from the deal and cancel at the last-minute without triggering a valid contingency, the refund for earnest money depends upon the seller. In legal terms, your seller can choose not to return your earnest money from the escrow fund to compensate for their lost time and having to take the property off the market due to your indecision.

Pro tip: only deposit earnest money and draw up a written contract of purchase with specified contingencies, if you’re a 100% sure that the property is your dream home and are willing to make a financial commitment towards it.

While earnest money is initially paid by the buyer to secure the home of their dreams, its purpose does not end there. Earnest money serves not only as an initial investment but also continues to benefit the buyer till the deal is closed and the house keys are in their hands by getting adjusted with the down payment.

The money that you deposit it as a part of earnest money in the escrow fund is not the same as your down payment. The purpose of earnest money and down payment are different, even if they appear to be the same. However, your earnest money that is deposited as a sign of good faith is adjusted with your down payment sum towards the closing of the deal, even though it is not a part of it.

That largely hinges on the conditions outlined in your agreement. If such conditions – such as financing, appraisal or inspection – aren’t satisfied, you’ll typically receive a refund. However, if you withdraw for reasons outside the contract, the owner may have the right to retain your deposit.

Yes absolutely – especially if specific terms in the contract are met. However, repayment isn’t always assured – hence you should read and review the agreement carefully.

Don’t let confusion about what is down payment and earnest money stand in between your dream home and you. Large financial transactions like buying a home are a huge commitment and with earnest money you can secure it while reducing the burden of a large down payment later on through adjustments.

Have more questions? Get in touch with our expert consultants at Club 720. Choose the best path to homeownership and make the right financial decisions for a commitment that lasts a lifetime!